Len Auck and Brian Land trade as partners in Auckland Manufacturing Company making components for minicomputers. To

Question:

Len Auck and Brian Land trade as partners in Auckland Manufacturing Company making components for minicomputers. To cope with increasing demand the partners intend to extend their manufacturing capacity but are concerned about the effect of the expansion on their cash resources during the build-up period from January to April 20X6.

The following information is available.

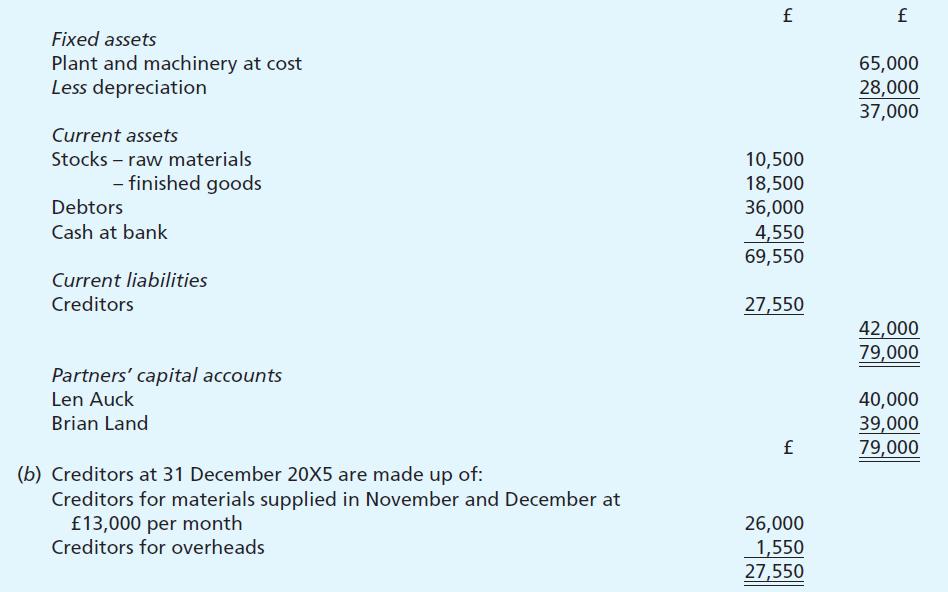

(a) The balance sheet of Auckland Manufacturing Company at 31 December 20X5 is expected to be:

(c) New plant costing £25,000 will be delivered and paid for in January 20X6.

(d) Raw material stocks are to be increased to £12,000 by the end of January 20X6, thereafter raw material stocks will be maintained at that level. Payment for raw materials is made two months after the month of delivery. Finished goods stocks will be maintained at £18,500 throughout the period. There is no work in progress.

(e) Sales for the four months are expected to be:

Sales for several months prior to 31 December had been running at the rate of £18,000 per month. It is anticipated that all sales will continue to be paid for two months following the month of delivery.

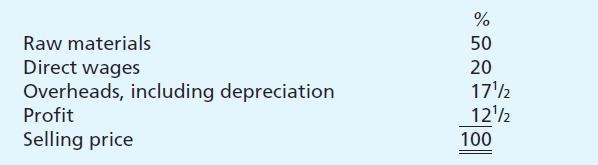

(f) The cost structure of the product is expected to be:

(g) Indirect wages and salaries included in overheads amount to £900 for the month of January and £1,000 per month thereafter.

(h) Depreciation of plant and machinery (including the new plant) is to be provided at £700 per month and is included in the total overheads.

(i) Wages and salaries are to be paid in the month to which they relate; all other expenses are to be paid for in the month following the month to which they relate.

(j) The partners share profits equally and drawings are £400 per month each.

(k) During the period to April an overdraft facility is being requested.

Required:

(a) A forecast profit and loss account for the four months January to April 20X6 and a balance sheet as at 30 April 20X6.

(b) A month by month cash forecast for the four months showing the maximum amount of finance required during the period.

(c) A calculation of the month in which the overdraft facility would be repaid on the assumption that the level of activity in April is maintained.

For the purposes of this question, taxation and bank interest may be ignored.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster