On 1 May 2011 Jenny Barnes, who is a retailer, had the following balances in her books:

Question:

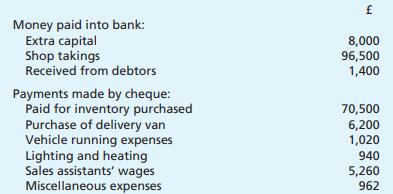

On 1 May 2011 Jenny Barnes, who is a retailer, had the following balances in her books: Premises £70,000; Equipment £8,200; Vehicles £5,100; Inventory £9,500; Trade accounts receivable £150. Jenny does not keep proper books of account, but bank statements covering the 12 months from 1 May 2011 to 30 April 2012 were obtained from the bank and summarised as follows:

It has been discovered that, in the year ending 30 April 2012, the owner had paid into the bank all shop takings apart from cash used to pay (i) £408 miscellaneous expenses and (ii) £500 per month drawings. At 30 April 2012: £7,600 was owing to suppliers for inventory bought on credit. The amount owed by trade accounts receivable is to be treated as a bad debt. Assume that there had been no sales on credit during the year. Inventory was valued at £13,620. Depreciation for the year was calculated at £720 (equipment) and £1,000 (vehicles). You are asked to prepare an income statement for the year ending 30 April 2012. (Show all necessary workings separately.) (Edexcel Foundation, London Examinations: GCSE)

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan