Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not keep

Question:

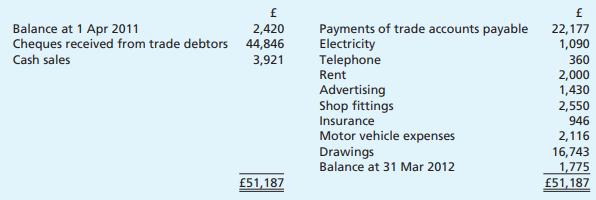

Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not keep complete accounting records, but is able to provide you with the following information about his financial position at 1 April 2011: Inventory of furniture £3,210; Trade accounts receivable £2,643; Trade accounts payable £1,598; Motor vehicle £5,100; Shop fittings £4,200; Motor vehicle expenses owing £432. He has also provided the following summary of his bank account for the year ended 31 March 2012:

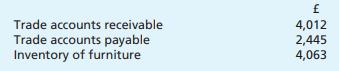

All cash and cheques received were paid into the bank account immediately. You find that the following must also be taken into account: l Depreciation is to be written-off the motor vehicle at 20% and off the shop fittings at 10%, calculated on the book values at 1 April 2011 plus additions during the year. l At 31 March 2012 motor vehicle expenses owing were £291 and insurance paid in advance was £177. l Included in the amount paid for shop fittings were: a table bought for £300, which Smithson resold during the year at cost, some wooden shelving (cost £250), which Smithson used in building an extension to his house. Other balances at 31 March 2012 were:

Required:

(a) For the year ended 31 March 2012 (i) calculate Smithson’s sales and purchases, (ii) prepare his income statement.

(b) Prepare Smithson’s statement of financial position as at 31 March 2012.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan