The accountant of Scampion plc, a retailing company listed on the London Stock Exchange, has produced the

Question:

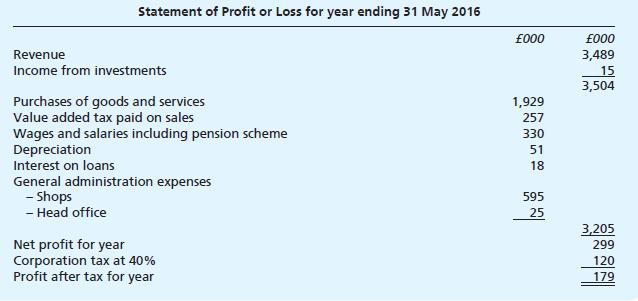

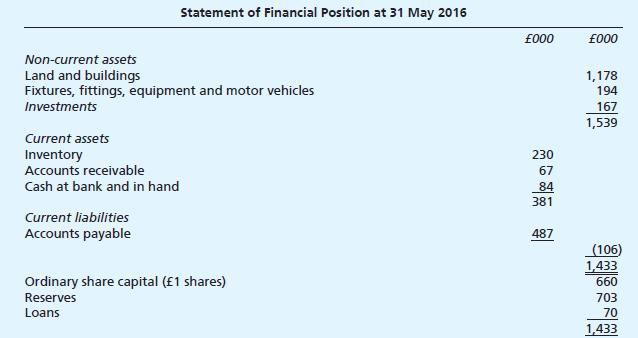

The accountant of Scampion plc, a retailing company listed on the London Stock Exchange, has produced the following draft financial statements for the company for the year to 31 May 2016.

You discover the following further information:

(i) Non-current assets details are as follows:

Purchases of non-current assets during the year were freehold land and buildings £50,000; fixtures, fittings and equipment £40,000; motor vehicles £20,000. The only non-current asset disposal during the year is referred to in note (x). Depreciation charged during the year was £5,000 for freehold buildings; £18,000 for fixtures, fittings and equipment; and £28,000 for motor vehicles. Straight line depreciation method is used assuming the following lives: Freehold

buildings 40 years, fixtures, fittings and equipment 10 years and motor vehicles five years.

(ii) A dividend of 10p per share is proposed.

(iii) A valuation by Bloggs & Co Surveyors shows the freehold land and buildings to have a market value of £1,350,000.

(iv) Loans are:

£20,000 bank loan with a variable rate of interest repayable by 30 September 2016;

£50,000 12% loan notes repayable 2020;

£100,000 11% loan notes repaid during the year.

There were no other loans during the year.

(v) The income from investments is derived from non-current asset investments (shares in related companies) £5,000 and current asset investment (government securities) £10,000.

(vi) At the date of the statement of financial position the shares in related companies (cost £64,000) are valued by the directors at £60,000. The market value of the government securities is £115,000 (cost £103,000).

(vii) After the date of the statement of financial position but before the financial statements are finalised there is a very substantial fall in share and security prices. The market value of the government securities had fallen to £50,000 by the time the directors signed the accounts. No adjustment has been made for this item in the accounts.

(viii) Within two weeks of the date of the statement of financial position a notice of liquidation was received by Scampion plc concerning one of the company’s debtors. £45,000 is included in the statement of financial position for this debtor and enquiries reveal that nothing is likely to be paid to any unsecured creditor. No adjustment has been made for this item in the accounts.

(ix) The corporation tax charge is based on the accounts for the year and there are no other amounts of tax owing by the company.

(x) Reserves at 31 May 2015 were:

The revaluation reserve represents the after-tax surplus on a property which was valued in last year’s statement of financial position at £400,000 and sold during the current year at book value.

Required:

A statement of profit or loss for the year ending 31 May 2016 and a statement of financial position at that date for Scampion plc complying with the Companies Acts in so far as the information given will allow.

Ignore advance corporation tax.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster