The accounting records of the Happy Tickers Sports and Social Club are in a mess. You manage

Question:

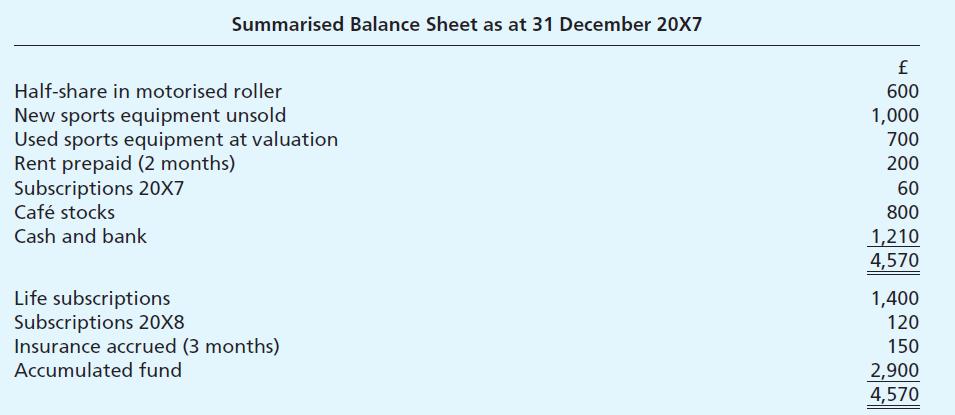

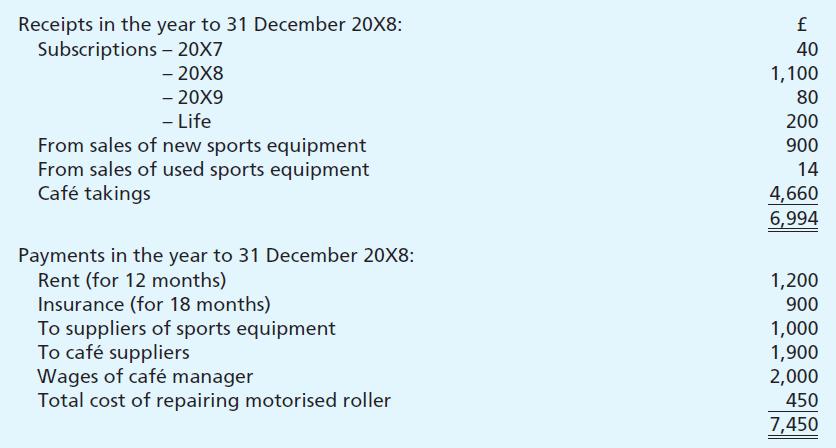

The accounting records of the Happy Tickers Sports and Social Club are in a mess. You manage to find the following information to help you prepare the accounts for the year to 31 December 20X8.

Notes:

(i) Ownership and all expenses of the motorised roller are agreed to be shared equally with the Carefree Conveyancers Sports and Social Club which occupies a nearby site. The roller cost a total of £2,000 on 1 January 20X6 and had an estimated life of 10 years.

(ii) Life subscriptions are brought into income equally over 10 years, in a scheme begun 5 years ago in 20X3. Since the scheme began the cost of £200 per person has been constant. Prior to 31 December 20X7 10 life subscriptions had been received.

(iii) Four more annual subscriptions of £20 each had been promised relating to 20X8, but not yet received. Annual subscriptions promised but unpaid are carried forward for a maximum of 12 months.

(iv) New sports equipment is sold to members at cost plus 50%. Used equipment is sold off to members at book valuation. Half the sports equipment bought in the year (all from a cash and carry supplier) has been used within the club, and half made available for sale, new, to members. The ‘used equipment at valuation’ figure in the 31 December 20X8 balance sheet is to remain at £700.

(v) Closing café stocks are £850, and £80 is owed to suppliers at 31 December 20X8.

Required:

(a) Calculate the profit on café operations and the profit on sale of sports equipment.

(b) Prepare a statement of subscription income for 20X8.

(c) Prepare an income and expenditure statement for the year to 31 December 20X8, and balance sheet as at 31 December 20X8.

(d) Why do life subscriptions appear as a liability?

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster