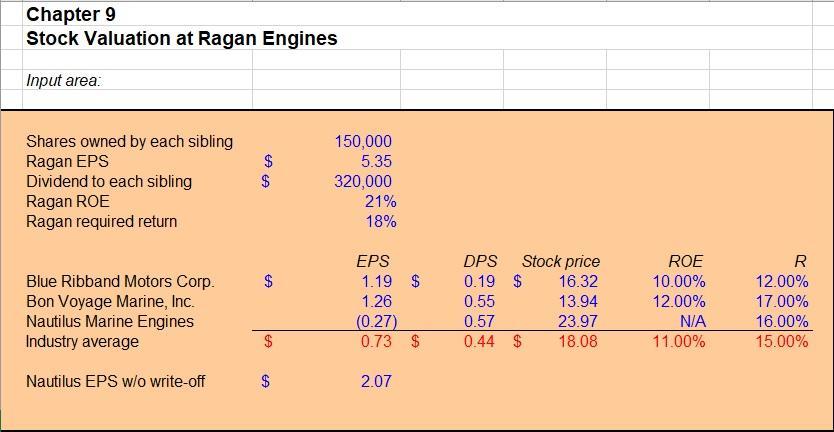

Chapter 9 Stock Valuation at Ragan Engines Input area: Shares owned by each sibling Ragan EPS Dividend to each sibling Ragan ROE Ragan required

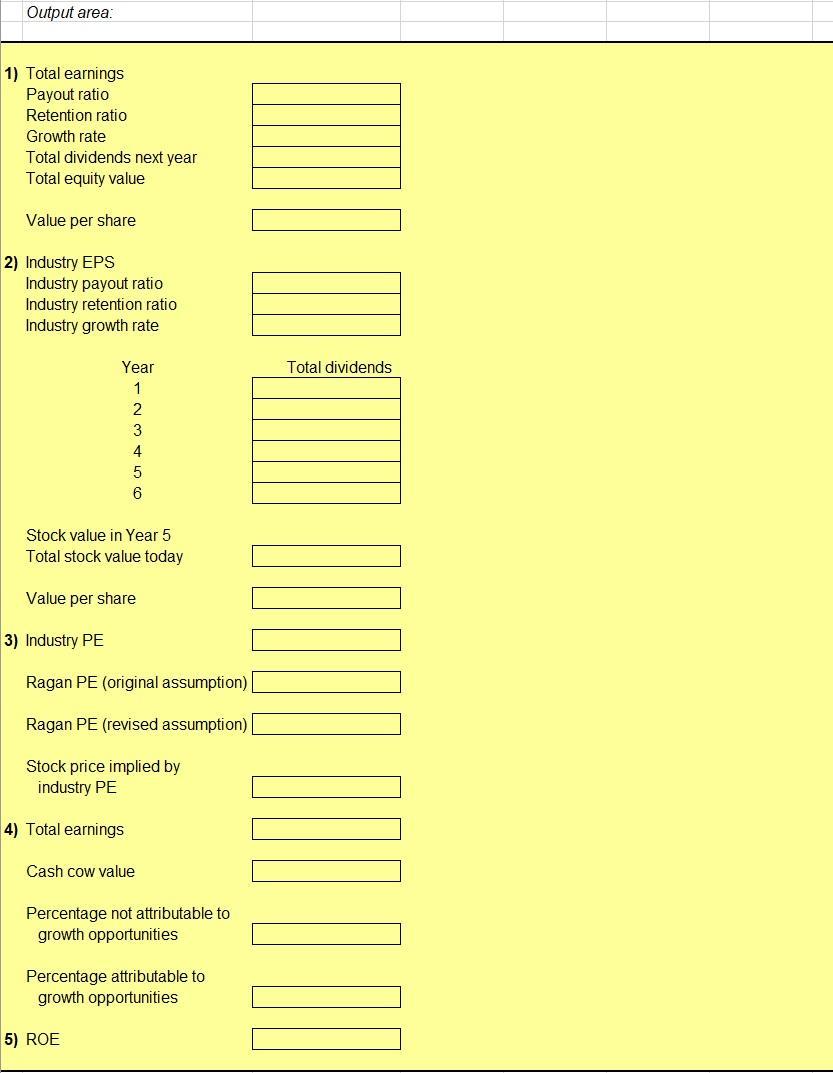

Chapter 9 Stock Valuation at Ragan Engines Input area: Shares owned by each sibling Ragan EPS Dividend to each sibling Ragan ROE Ragan required return Blue Ribband Motors Corp. Bon Voyage Marine, Inc. Nautilus Marine Engines Industry average Nautilus EPS w/o write-off LA LA $ $ $ 150,000 5.35 320,000 21% 18% EPS 1.19 $ 1.26 (0.27) 0.73 $ 2.07 DPS 0.19 $ 0.55 0.57 0.44 $ Stock price 16.32 13.94 23.97 18.08 ROE 10.00% 12.00% N/A 11.00% R 12.00% 17.00% 16.00% 15.00% Output area: 1) Total earnings Payout ratio Retention ratio Growth rate Total dividends next year Total equity value Value per share 2) Industry EPS Industry payout ratio Industry retention ratio Industry growth rate Year 1 2 3 4 5 6 Stock value in Year 5 Total stock value today Value per share 3) Industry PE Ragan PE (original assumption) | Ragan PE (revised assumption) Stock price implied by industry PE 4) Total earnings Cash cow value Percentage not attributable to growth opportunities 5) ROE Percentage attributable to growth opportunities Total dividends |||||

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The only point to be noted here is that for Nautilus the EPS of 207 should be taken ie without the w... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards