The chairman of a family business has been examining the following summary of the accounts of the

Question:

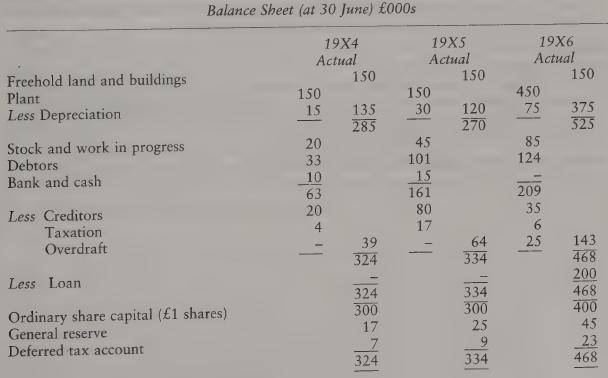

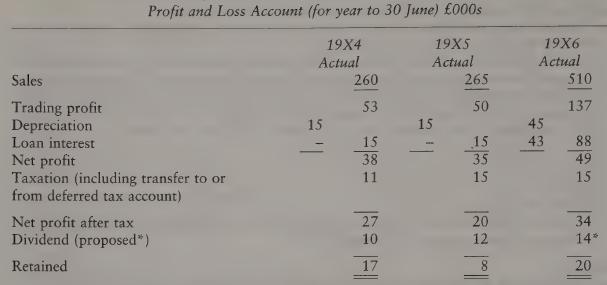

The chairman of a family business has been examining the following summary of the accounts of the company since it began three years ago.

The company’s products are popular in the locality and in the first two years sales could have been higher if there had been extra machine capacity available.

On 1 January 19X6, additional share and loan capital was obtained which enabled extra machinery to be purchased. This gave an immediate increase in sales and profits.

Although 19X5/X6 showed the best yet results, the chairman is not very happy; the accountant has suggested that a dividend should not be paid this year because of the overdraft. The accountant has, however, shown a proposed dividend of £14,000 (£2,000 up on last year) for purposes of comparison pending a decision by the directors.

Naturally, the chairman is displeased and wants some explanations from the accountant regarding the figures in the accounts.

He specifically asks:

(i) Why, if profits are the best ever and considering the company has obtained extra capital during the year, has the company gone into overdraft? Can there really be a profit if there is no cash left in the bank to pay a dividend?

(ii) Why is the freehold still valued at the same price as in 19X4? The real value seems to be about £225,000. Why is this real value not in the balance sheet?

Required:

Write a report to the chairman:

(a) commenting on the state and progress of the business as disclosed by the accounts and the above information, supporting your analysis by appropriate key accounting ratios, and

(b) giving reasoned answers, in the context of recognised accounting law, rules and practices, to each of the questions raised by the chairman.

Step by Step Answer: