The financial statements of Arms Ltd are made up to 31 March in each year. Work on

Question:

The financial statements of Arms Ltd are made up to 31 March in each year. Work on a certain contract started on 1 July 20X6 and completed on 31 January 20X8. The total contract price was £360,000, but a penalty of £5,000 was suffered for failure to complete by 31 December 20X7.

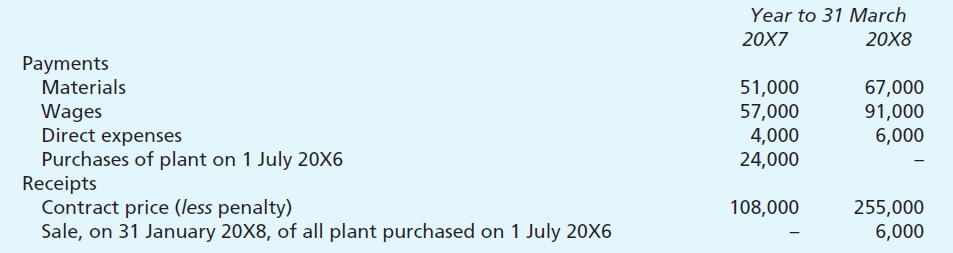

The following is a summary of receipts and payments relating to the contract:

The amount received from the customer in 20X7 represented the contract price of all work certified in that financial year less 10 per cent retention money.

When the financial statements to 31 March 20X7 were prepared, it was estimated that the contract would be completed on 31 December 20X7, and that the market value of the plant would be £6,000 on that date. It was estimated that further expenditure on the contract would be £161,000.

For the purposes of the financial statements, depreciation of plant is calculated, in the case of uncompleted contracts, by reference to the expected market value of the plant on the date when the contract is expected to be completed, and is allocated between accounting periods by the straight line method.

Credit is taken, in the financial statements, for such a part of the estimated total profit, on each uncompleted contract, as corresponds to the proportion between the contract price of the work certified and the total contract price.

Required:

Prepare a summary of the account for this contract, showing the amounts transferred to the profit and loss account at 31 March 20X7 and 31 March 20X8.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster