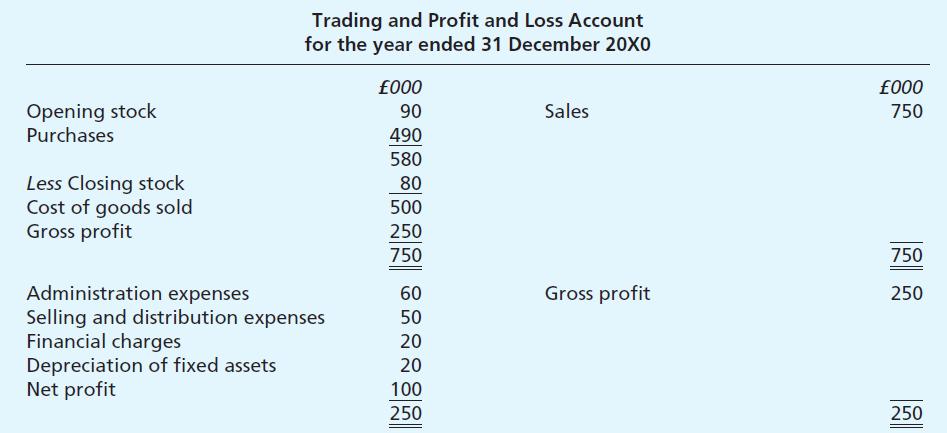

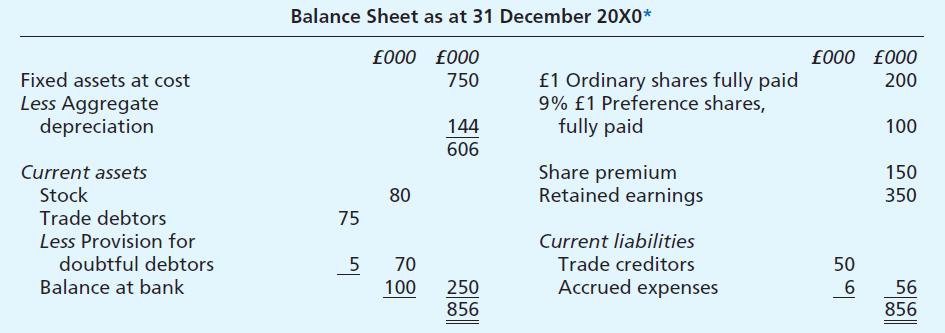

The following information has been extracted from the books of Issa Ltd for the financial year ended

Question:

The following information has been extracted from the books of Issa Ltd for the financial year ended 31 December 20X0.

The company had commenced the preparation of its budget for the year ending 31 December 20X1 and the following information is the basis of its forecast.

1. An intensive advertising campaign will be carried out in the first six months of 20X1 at a cost of £15,000. It is anticipated that as a result of this, sales will increase to £900,000 in 20X1.

2. The gross profit/sales ratio will be increased to 35 per cent.

3. A new stock control system is to be installed in 20X1 and it is expected that the stock level will be reduced by £15,000 as compared to the 20X0 closing stock.

4. Land and buildings which cost £50,000 (nil depreciation to date) will be sold in 20X1 for £200,000 cash. Half of the proceeds will be used to buy ordinary shares in another company, Yates Ltd, at an agreed price of £4 per share. (Ignore share commission etc.)

5. The company planned to capitalise some of its reserves on 1 April 20X1. New ordinary shares are to be issued on a 1 for 2 basis. Half the funds required will be drawn from the share premium account and the remainder will be taken from retained earnings.

6. Preference share dividends will be paid on 1 May 20X1 and 1 November 20X1. The company planned to pay an interim ordinary share dividend on the increased share capital of 2.5p per share on 1 July 20X1. No final dividend is proposed.

7. Owing to inflation revenue expenses are expected to rise as follows: Administration expenses will increase by 6 per cent.

Selling and distribution expenses will increase by 8 per cent.

The advertising campaign expenses are in addition to the increase above.

Financial charges will increase by 4 per cent.

These percentage increases are based on the figures for the year ended 31 December 20X0.

8. With the projected sales increases trade debtors are expected to rise to £100,000 by 31 December 20X1. The provision for doubtful debts is to be adjusted to 71/2 per cent of forecast trade debtors.

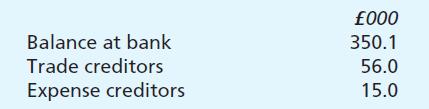

9. Other forecast figures as at 31 December 20X1.

10. Depreciation of 10 per cent per annum on cost is to be provided on £600,000 of the company’s fixed assets.

Required:

(a) A budgeted trading, profit and loss and appropriation account for the year ending 31 December 20X1.

Show the full details of the trading account.

(b) A budgeted balance sheet as at 31 December 20X1.

(c) What advantages accrue to a business by preparing a budget with respect to

(i) Forecast profitability;

(ii) Forecast liquidity?

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster