Wren Electronics Ltd has capital available for investment in new equipment and the directors are considering two

Question:

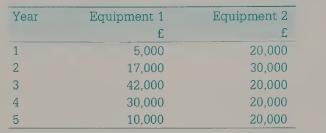

Wren Electronics Ltd has capital available for investment in new equipment and the directors are considering two 5-year projects, only one of which can be financed. Details of the annual net cash flows are as follows:

In both cases, the project will require an average investment of £50,000. Annual profit before interest and tax will be based on net cash flows less annual depreciation on the equipment. This will be based on the straight-line method over 5 years with no residual value at the end of the project. You should assume that the annual cash flows shown in the above table arise evenly throughout the year.

(a) Calculate the payback period for each project.

(b) Calculate the accounting rate of return for each project.

(c) Recommend which of the two projects is likely to be the better investment, giving reasons to support your advice.

(d) Comment on any limitations of the techniques you have used.

Step by Step Answer:

Business Accounting An Introduction To Financial And Management Accounting

ISBN: 9780230276239

2nd Edition

Authors: Jill Collis, Roger Hussey, Andrew Holt, Holt Collis, J. Collis