XY Ltd provides for depreciation of its machinery at 20% per annum on cost; it charges for

Question:

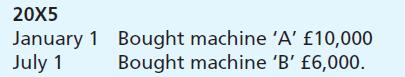

XY Ltd provides for depreciation of its machinery at 20% per annum on cost; it charges for a full year in the year of purchase but no provision is made in the year of sale/disposal.

Financial statements are prepared annually to 31 December.

Prepare

(a) The machinery account for the period 1 January 20X5 to 31 December 20X8.

(b) The accumulated provision for depreciation on machinery account, for the period 1 January 20X5 to 31 December 20X8.

(c) The disposal of machinery accounts showing the profit/loss on sale for each year.

(d) The balance sheet extract for machinery at (i) 31 December 20X7 and (ii) 31 December 20X8.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster

Question Posted: