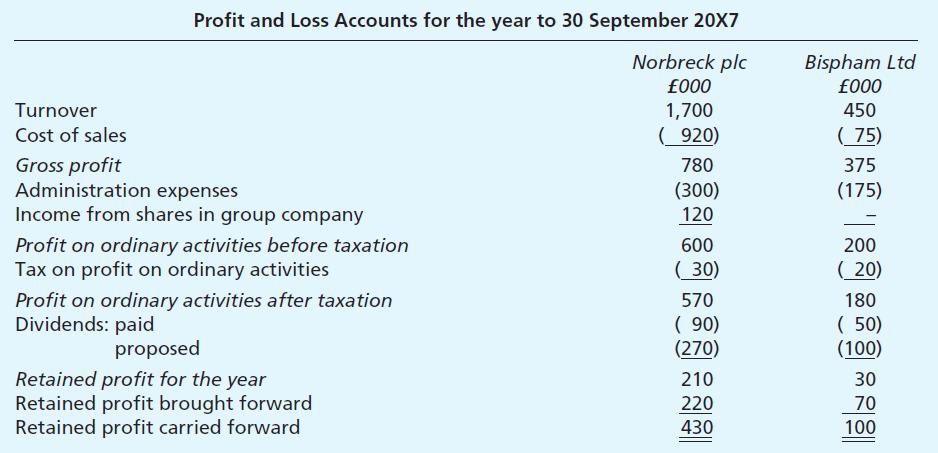

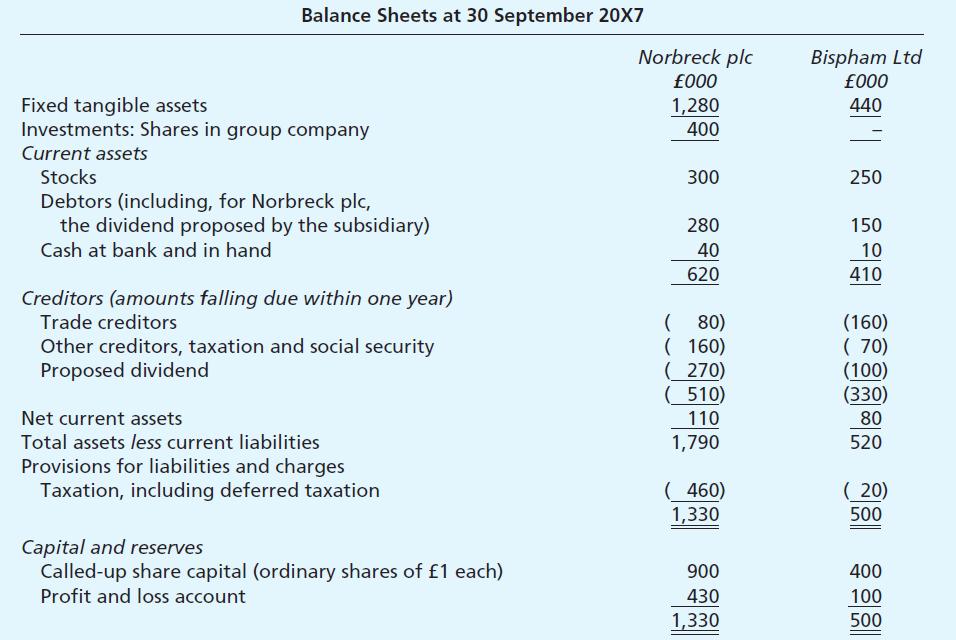

You are presented with the following summarised information for Norbreck plc and its subsidiary, Bispham Ltd: Additional

Question:

You are presented with the following summarised information for Norbreck plc and its subsidiary, Bispham Ltd:

Additional information:

(a) Norbreck plc acquired 80 per cent of the shares in Bispham Ltd on 1 October 20X4. Bispham’s profit and loss account balance as at that date was £40,000.

(b) Goodwill arising on acquisition is to be written off against the group’s retained profits.

(c) Norbreck takes credit within its own books of account for any dividends receivable from Bispham.

Required:

Prepare Bispham plc’s consolidated profit and loss account for the year to 30 September 20X7 and a consolidated balance sheet as at that date.

Formal notes to the account are not required, although detailed workings should be submitted with your answer. You should also append to the consolidated profit and loss account your calculation of earnings per share and a statement showing the make-up of ‘retained profits carried forward’.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster