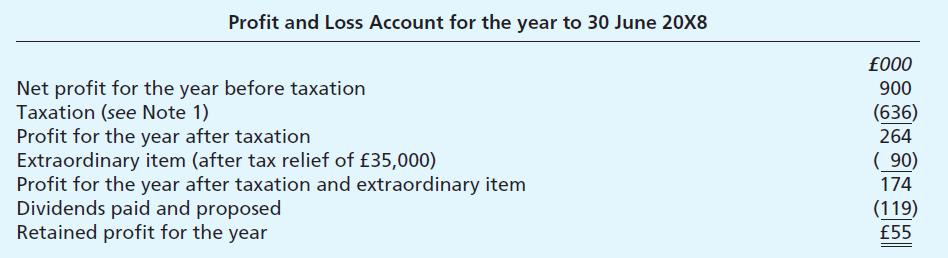

You are presented with the following summarised information relating to Ward plc: Notes: 1. The taxation charge

Question:

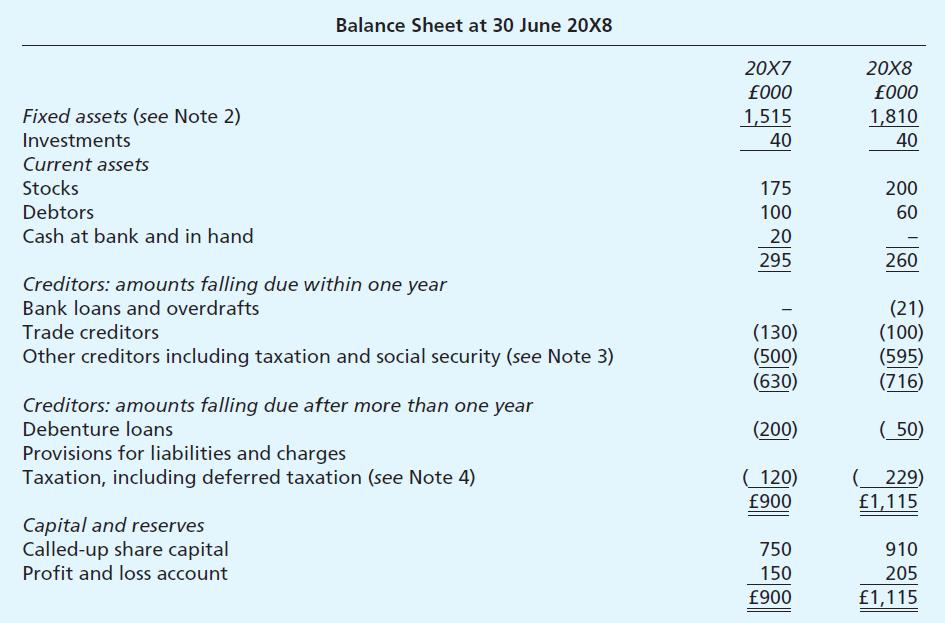

You are presented with the following summarised information relating to Ward plc:

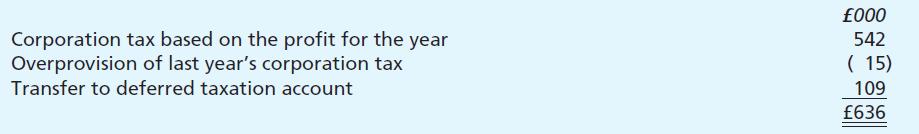

Notes:

1. The taxation charge in the profit and loss account includes the following items:

2. During the year to 30 June 20X8, Ward sold an asset originally costing £150,000 for £5,000 in cash. The depreciation charged on this asset was £135,000. The total depreciation charged in the profit and loss account for the year to 30 June 20X8 was £384,000.

3. Other creditors including taxation and social security includes the following items:

4. The deferred taxation balances include the following items:

Required:

In so far as the information permits, prepare Ward plc’s statement of cash flow for the year to 30 June 20X8 in accordance with FRS 1.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster