You are the independent auditor for the Scoopa Co. When you had completed your audit for the

Question:

You are the independent auditor for the Scoopa Co. When you had completed your audit for the preceding year, management asked your assistance in arriving at a decision whether to continue manufacturing a part or to buy it from an outside supplier. The part, which is named Faktron, is a component used in some of the finished products of the company.

From your audit working papers and from further investigations you develop the following data relative to the company's operations:

(i) The annual requirement of Faktrons is 5,000 units. The lowest price quotation from a supplier was £8 per unit.

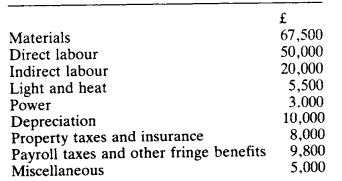

(ii) Faktrons have been manufactured in the Precision Machinery Department. Following are the total costs of this department during the preceding year when 5,000 Faktrons were produced:

Materials Direct labour Indirect labour Light and heat Power Depreciation Property taxes and insurance Payroll taxes and other fringe benefits Miscellaneous 67,500 50,000 20,000 5,500 3.000 10,000 8,000 9,800 5,000 Discontinuing production of Faktrons would reduce the operation volume of the Precision Machinery Department but would not permit the disposal of any of the department's assets, (iii) The following proportions of the variable costs in the Precision Machinery Department are directly traceable to Faktrons:

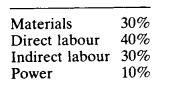

Materials 30%

Direct labour 40%

Indirect labour 30%

Power 10%

(iv) If Faktrons are purchased from an outside supplier, shipping charges would average £0.5 per unit and indirect labour in the Precision Machinery Department would be increased by £5,000 for receiving, inspecting, and handling.

Required:

(a) Prepare a schedule showing the relative costs of making and buying Faktrons to assist management in reaching a decision.

(b) Discuss the consideration in addition to costs that you would bring to the attention of management in helping them make a decision in this situation.

Step by Step Answer: