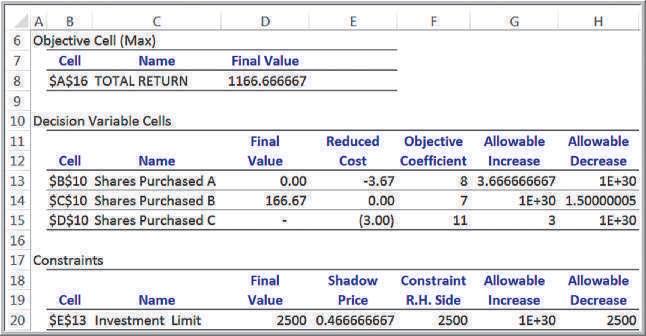

Figure 13.35 shows the Solver sensitivity report for the investment scenario in Problem 4. Using only the

Question:

Figure 13.35 shows the Solver sensitivity report for the investment scenario in Problem 4.

Using only the information in the sensitivity report, answer the following questions.

a. How much would the return on stock A have to increase to invest fully in that stock?

b. How much would the return on stock C have to be to invest fully in that stock?

c. Explain the value of the shadow price for the total investment constraint. If the student could borrow $1,000 at 8% a year to increase her total investment, what would you recommend and why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: