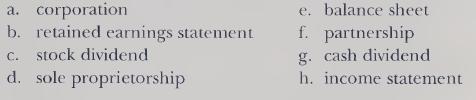

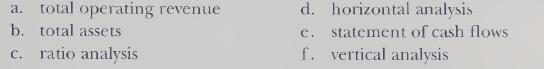

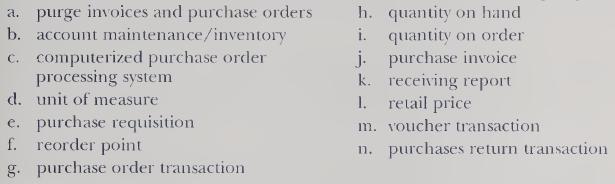

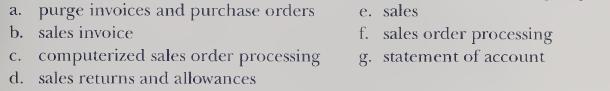

Integrated Accounting For Windows 6th Edition Dale A. Klooster, Warren Allen - Solutions

Discover comprehensive solutions for "Integrated Accounting For Windows 6th Edition" by Dale A. Klooster and Warren Allen. Access answers key and solutions in PDF format for your textbook, including solved problems and step-by-step answers. Our online platform offers a complete solution manual, test bank, and instructor manual to aid your learning. Explore chapter solutions and questions and answers that facilitate a deeper understanding of the material. Benefit from free downloads to enhance your study experience and excel in your accounting course.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()