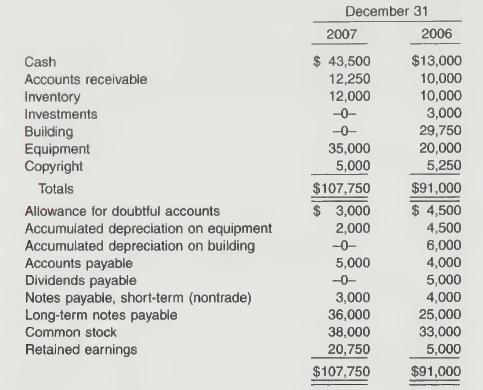

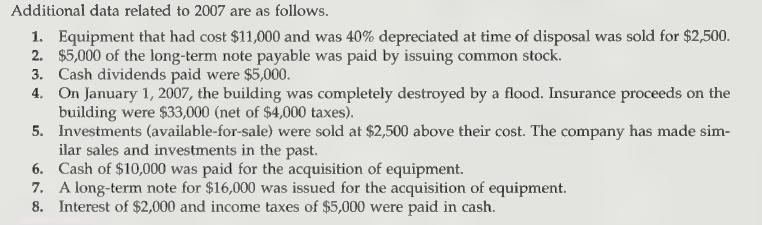

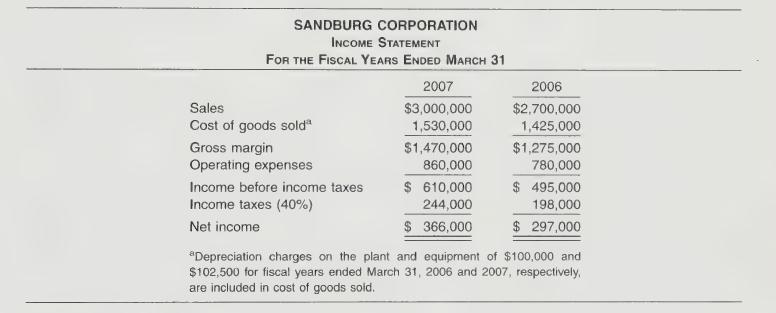

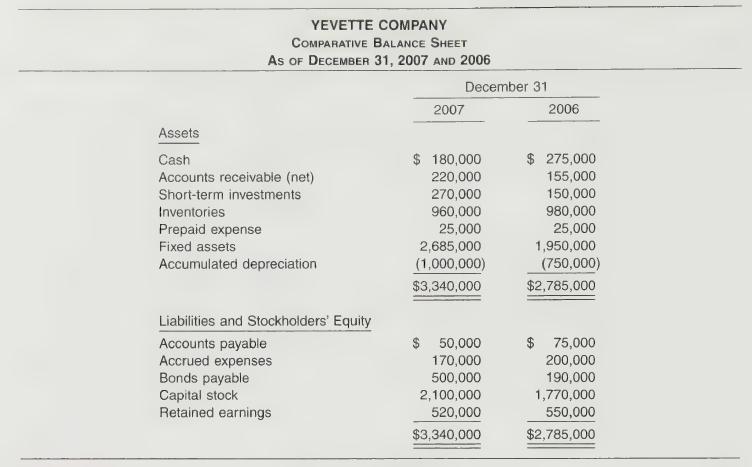

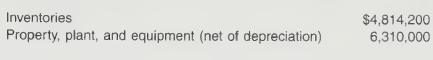

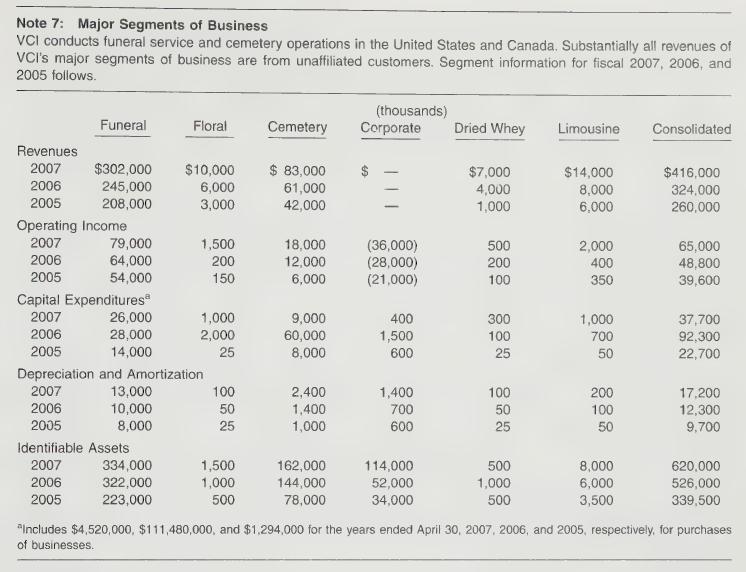

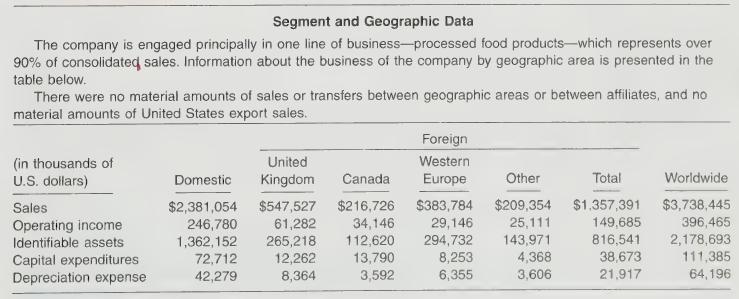

Intermediate Accounting 2007 FASB Update Volume 2 12th Edition Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield - Solutions

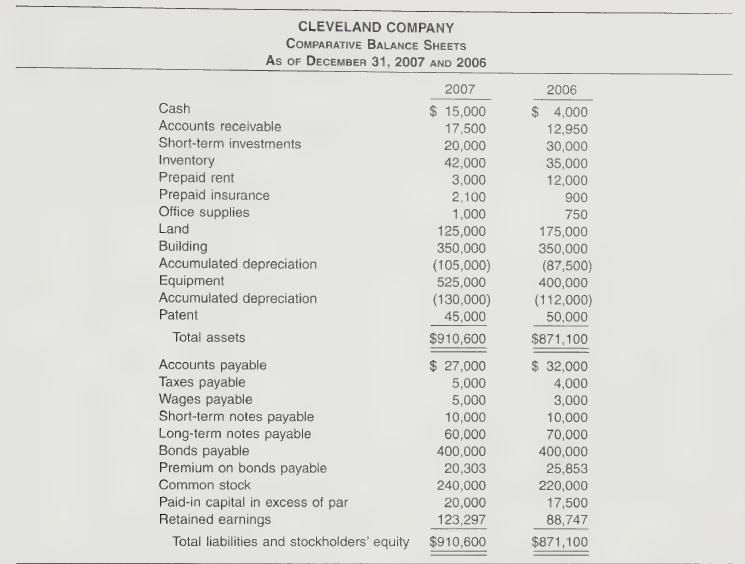

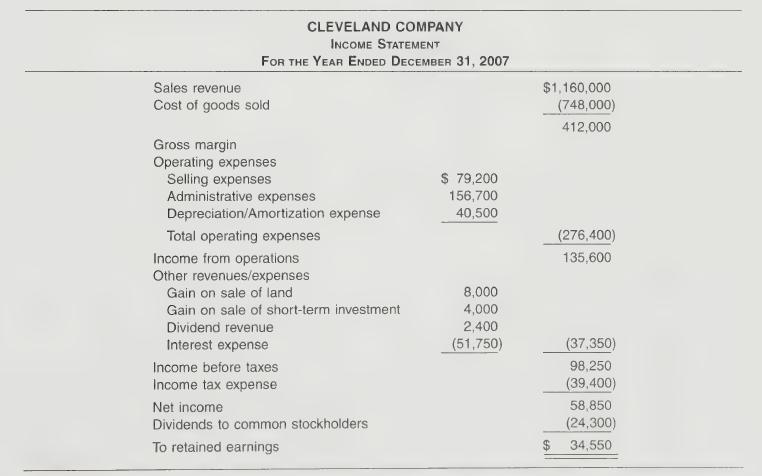

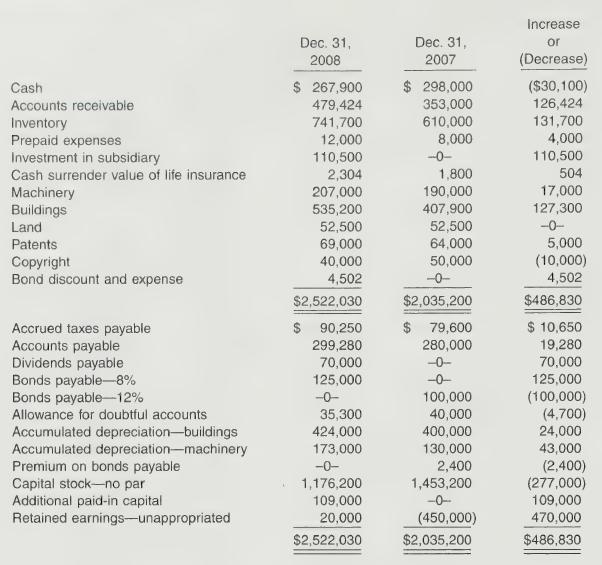

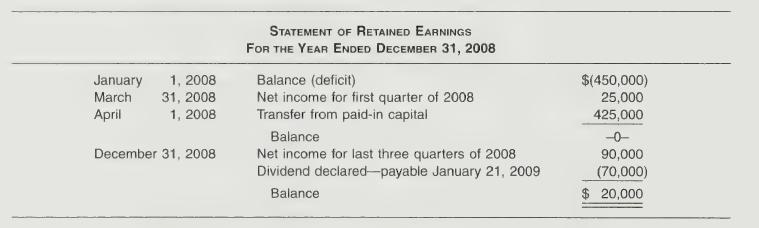

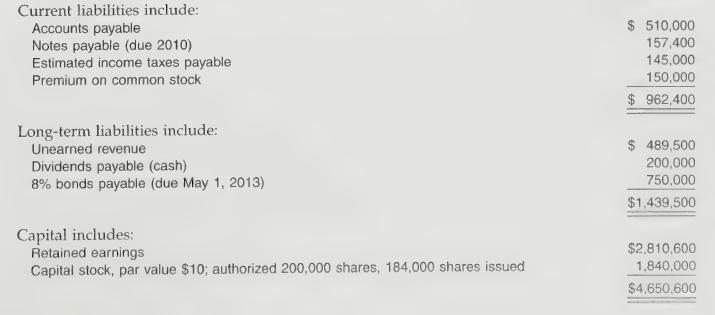

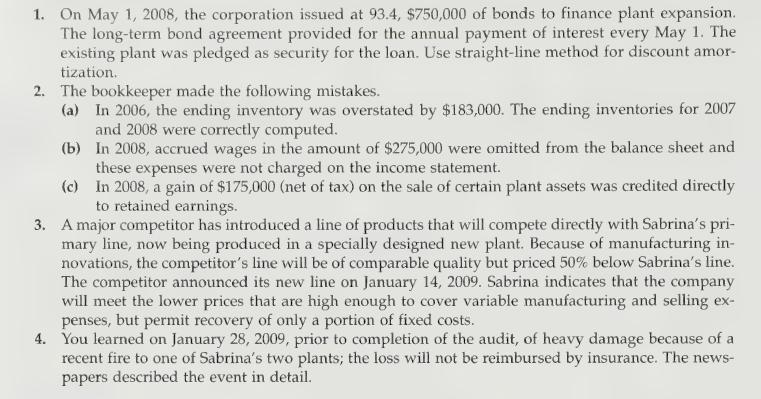

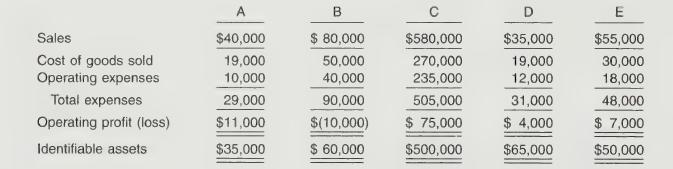

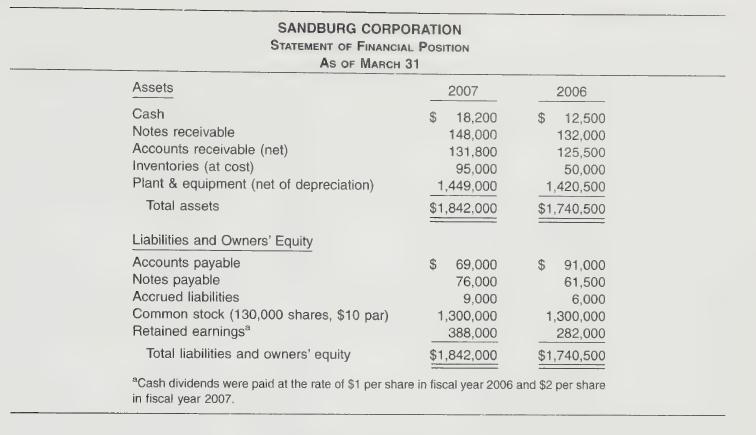

Unlock the potential of your studies with the comprehensive "Intermediate Accounting 2007 FASB Update Volume 2, 12th Edition" by Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield. Dive into a treasure trove of resources, including an online solution manual, answers key, and step-by-step solutions pdf. Our expertly crafted test bank and instructor manual offer solved problems and chapter solutions tailored for in-depth understanding. Enhance your learning experience with these questions and answers, ensuring a thorough grasp of textbook concepts. Explore the convenience of free download options, empowering your academic journey.

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()