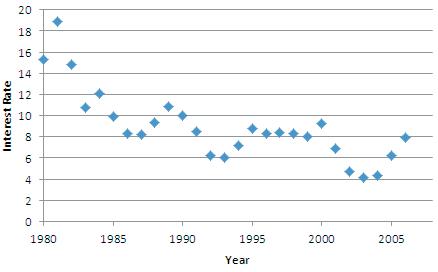

Banks annual interest rates. Average annual interest rates (banks prime lending) in the United States from 1980

Question:

Banks annual interest rates. Average annual interest rates (banks prime lending) in the United States from 1980 through 2005 are shown in the following time series graph

(unstats.un.org), created in Excel.

a) What components do you see in this series?

Here’s a linear trend model fit to these data.

Dependent variable is: Interest Rate R squared = 59.8% R squared (adjusted) = 58.1%

s = 2.161 with 27 - 2 = 25 degrees of freedom Variable Coeff SE(Coeff) t-ratio P-value Intercept 657.353 106.4 6.18 0.0001 Year 0.325342 0.0534 6.09 0.0001

b) Interpret the trend coefficient mean in this model.

c) Predict the interest rate for 2005. Do you trust the prediction? Why or why not?

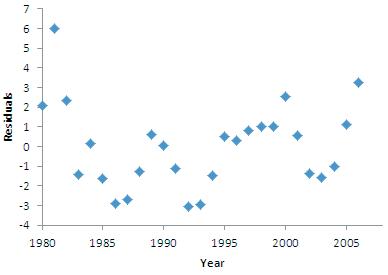

Here’s a time series plot of the residuals from this model, created in Excel.

d) Discuss any patterns you see in this plot.

e) Would an exponential model be likely to do better for these data? Explain.

Step by Step Answer:

Business Statistics

ISBN: 9780321716095

2nd Edition

Authors: Norean D. Sharpe, Paul F. Velleman, David Bock, Norean Radke Sharpe