A bank owns a portfolio of bonds whose value P(r) depends on the interest rate r (measured

Question:

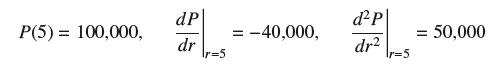

A bank owns a portfolio of bonds whose value P(r) depends on the interest rate r (measured in percent; e.g., r = 5 means a 5% interest rate). The bank’s quantitative analyst determines that

In finance, this second derivative is called bond convexity. Find the second Taylor polynomial of P(r) centered at r = 5 and use it to estimate the value of the portfolio if the interest rate moves to r = 5.5%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: