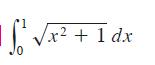

Evaluate the integral. S x + 1 dx 2

Question:

Evaluate the integral.

Transcribed Image Text:

S √x² + 1 dx 2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To evaluate the integral x2 1 dx from 0 to 1 you can use a trigonometric subst...View the full answer

Answered By

Sumit kumar

I am an experienced online essay writer with a thorough understanding of any curriculum.and subject expert at Chegg for mathematics, CS subjects..

4.90+

5+ Reviews

13+ Question Solved

Related Book For

Question Posted:

Students also viewed these Mathematics questions

-

1 . You are abducted by aliens who transport you to their home world in a galaxy far far away. Oddly, the only thing you can think of doing is measuring the acceleration due to gravity on this...

-

In Problems 19-38, evaluate the given improper integral or show that it diverges? 1. 2. 3. 4. 5. dx Jo (x +1) dx -1

-

Evaluate each definite integral in Problems 15-20. Use Table II on pages 926-928 to find the and derivative. 2 (6+x)2 (677)2dx

-

An analyst predicted the following: 1. Sales of $1,276 million. 2. Core profit margin of 5 percent. 3. Asset turnover of 2.2. 4. Core other operating income and unusual items are zero. The firm's...

-

Describe the steps involved in conducting a time study, and discuss any difficulties you might envision at various steps.

-

Hudson Companys trial balance as of January 1, the beginning of its fiscal year, is given below: Hudson Company uses a job-order costing system. During the year, the following transactions took...

-

Was Betfair justified in taking the extreme step of voiding all bets on the match?

-

The Canton Corporation shows the following income statement. The firm uses FIFO inventory accounting. CANTON CORPORATION Income Statement for 2013 Sales $272,800 (17,600 units at $15.50) Cost of...

-

State whether the following statements are TRUE (T) or FALSE (F) Documentation can be thought of as a tool for information transmission and communication. Business Process Modeling Notation (BPMN)...

-

Evaluate the integral. ds 5(5-1)

-

Evaluate the integral. TT/2 S." sec(1/2) dt

-

Why do you think an initiator molecule is needed to induce the polymerization of ethylene?

-

Why the sudden increase in income before taxes in 2021? 8. Why were the operating assets the highest in 2019? 9. Why are the short-term loans the highest in 2020? 10. Why are the other long-term...

-

Mercy wants to make sure that she will be able to provide for her daughter's college and plans to open a savings account with a bank that is ready to pay interest as shown below per year compounded...

-

Question 1. For a firm that uses portfolio management, please give a real or hypothetical example of how the CEO's personal bases for power help organizational performance. Question 2. Give a real...

-

Make a schedule that you would use that effectively illustrates working with paraprofessionals that includes collaboration time. Use the examples provided in the following resources to guide your...

-

How does the integration of technology and automation influence employee motivation and job satisfaction within modern organizational contexts ?

-

Triton Consulting is a consulting firm owned and operated by Jayson Neese. The ollowing end-of-period spreadsheet was prepared for the year ended April 30, 2018: Based on the preceding spreadsheet,...

-

Cobb Manufacturing Company uses a process cost system and average costing. The following production data is for the month of June 2011. Production Costs Work in process, beginning of the month:...

-

Use the formula in the indicated entry of the Table of Integrals on Reference Pages 6 10 to evaluate the integral. 10- 5 dt; entry 41

-

Evaluate the integral. cos 3 (t/2) sin 2 (t/2) dt

-

Three integrals are given that, although they look similar, may require different techniques of integration. Evaluate the integrals. a. b. c. x cos x? dx

-

What are three methods to overcome the provisons of the Tax Cuts and Jobs Act on subpart F on a controlled foreign corporation's tax liabilty? on subpart F to reduce a CFC's tax liability*

-

MULTIPLE CHOICE ASAP PLS WILL UPVOTE 11 Multiple Choice $14,400. $85,600. $9,400. $5,760. $28,000

-

Instructions The net income reported on the income statement for the current year was $371,000. Depreciation recorded on store equipment for the year amounted to $16.880 Balances of the current asset...

Study smarter with the SolutionInn App