For some annuities encountered in business finance, called growing annuities, the amount of the periodic payment is

Question:

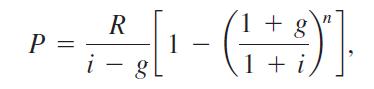

For some annuities encountered in business finance, called growing annuities, the amount of the periodic payment is not constant but grows at a constant periodic rate. Leases with escalation clauses can be examples of growing annuities. The present value of a growing annuity takes the form

where

R = amount of the next annuity payment,

g = expected constant annuity growth rate,

i = required periodic return at the time the annuity is evaluated,

n = number of periodic payments.

A corporation’s common stock may be thought of as a claim on a growing annuity where the annuity is the company’s annual dividend. However, in the case of common stock, these payments have no contractual end but theoretically continue forever. Compute the limit of the expression above as n approaches infinity to derive the Gordon–Shapiro Dividend Model popularly used to estimate the value of common stock. Make the reasonable assumption that i > g.

Step by Step Answer: