Beth and Zara are in partnership. They provide office services to local businesses. Their financial year ends

Question:

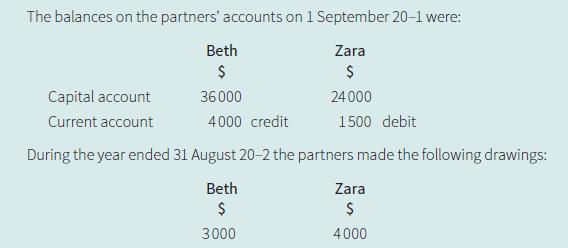

Beth and Zara are in partnership. They provide office services to local businesses. Their financial year ends on 31 August. They share profits and losses in the ratio of 3:2 respectively.

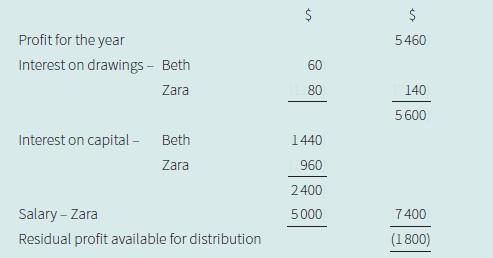

The partially completed profit and loss appropriation account for the year ended 31 August 20–2 showed the following:

On 31 August 20–2 the following balances remained in the books of the partnership:

$

Office furniture and equipment ....................... 36,850

Motor vehicles ..................................................... 18,250

Trade payables ......................................... 4,200

Trade receivables ......................................... 6,120

Other payables ......................................... 150

Other receivables ......................................... 310

Balance at bank ......................................... 3,780

a. Prepare the statement of financial position at 31August 20–2. Full details of the current accounts should be shown within the statement.

b. i. Calculate the rate of interest which has been charged on partners’ drawings.

ii. Calculate the rate of interest allowed on partners’ capital.

Beth and Zara are considering converting their partnership into a limited company.

c. i. State one advantage to Beth and Zara of converting the partnership to a limited company.

ii. State one disadvantage to Beth and Zara of converting the partnership to a limited company.

As an alternative to converting to a limited company, Beth is considering making a loan to the partnership.

d. Suggest two advantages to Beth of making a 5% five year loan to the partnership rather than investing additional capital.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom