Hamid and Waheed are in partnership. Their financial year ends on 31 August. The partnership agreement provides

Question:

Hamid and Waheed are in partnership. Their financial year ends on 31 August. The partnership agreement provides for the following:

Interest on capital at 4% per annum

Interest on drawings at 3% per annum

Partnership salary for Waheed at $5,000 per annum

Residual profits and losses to be shared 3:2

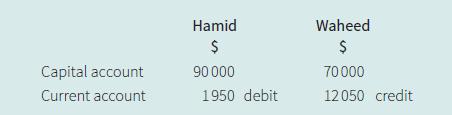

The balances on the partners’ accounts on 1 September 20–5 were:

Hamid invested $20,000 additional capital on 1 March 20–6. On the same date the partners decided to amend the partnership agreement to increase Waheed’s salary to $7,000 per annum.

During the year ended 31 August 20–6 the partners’ drawings were: Hamid $4,200 and Waheed $7,200.

Profit for the year ended 31 August 20–6 was $19,463.

a. Prepare the profit and loss appropriation account for the year ended 31 August 20–6.

b. Prepare the partners’ current accounts for the year ended 31 August 20–5. Balance the accounts and bring down the balances on 1 September 20–5.

c. Prepare an extract from the statement of financial position at 31 August 20–6 to showthe capital and current accounts of the partners. Full details of the current accounts are not required.

Waheed transferred $10,000 from his current account to his capital account on 1 September 20–6. On the same date he transferred office equipment, $2,000, to the business.

d. Prepare journal entries to record these transactions. Narratives are required.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom