Priti is a trader. Her financial year ends on 31 March. Her trial balance on 31 March

Question:

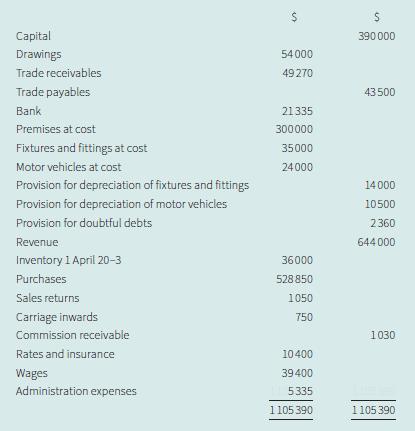

Priti is a trader. Her financial year ends on 31 March. Her trial balance on 31 March 20–4 was as follows:

Additional information:

1. At 31 March 20–4:

Inventory was valued at $41,050.

Commission receivable outstanding amounted to $110.

Insurance prepaid amounted to $180.

Rates accrued amounted to $260.

Wages accrued amounted to $1,600.

2. A debt of $150 should be written off as irrecoverable and the provision for doubtful debts should be maintained at 5% of the remaining trade receivables.

3. Fixtures and fittings are being depreciated at 20% per annum using the straight line method.

4. Motor vehicles are being depreciated at 25% per annum using the reducing balance method.

a. Prepare the income statement for the year ended 31 March 20–4.

b. Prepare the statement of financial position at 31 March 20–4.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom