William is a trader. His financial year ends on 31 December. He rents business premises. The monthly

Question:

William is a trader. His financial year ends on 31 December. He rents business premises. The monthly rent of $1,350, payable in advance on the first day of each month, was increased to $1,380 from 1 July 20–1. William paid six months’ rent in advance by direct debit on the following dates in 20–1: 1 January, 1 July and 31 December.

a. i. Prepare the rent payable account in William’s ledger for the year ended 31 December 20–1.

Balance the account and bring down the balance on 1 January 20–2.

ii. Prepare a relevant extract from William’s statement of financial positon at 31 December 20–1.

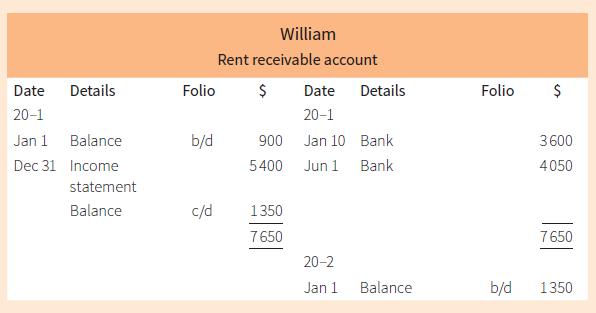

William sublets part of his business premises to a tenant. The monthly rent is $450.The rent receivable account in William’s ledger for the year ended 31 December 20–1 was as follows:

b. i. Name the ledger in which this account would appear.

ii. Explain each entry in the account.

iii. State where the balance on the account on 31 December 20–1 would appear in the statement of financial position.

On 1 January 20–1 William had stationery valued at $80. During the year ended 31 December 20–1 the following transactions took place:

February 1 Purchased stationery, $64, and paid in cash.

August 31 Purchased stationery, $18, using petty cash.

William’s inventory of stationery on 31 December 20–1 was valued at $75.

c. Write up the stationery account in William’s ledger for the year ended 31 December 20–1. Balance the account and bring down the balance on 1 January 20–2.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom