Little Boy Ltd. is a Canadian public corporation whose shares are traded on the Alberta Stock Exchange.

Question:

Little Boy Ltd. is a Canadian public corporation whose shares are traded on the Alberta Stock Exchange. The company operates a chain of grocery stores in western Canada. Little Boy began as a small family business owned by the three Hardy brothers, but grew rapidly due to the brothers? aggressive business policies and their ability to identify prime locations for their stores. Ten years ago, the company became a public corporation; it raised substantial equity and used it to fund a major expansion. Much of the funding was used to acquire land and construct stores according to the particular specifications that suited their business.

Even after the public share issue, the Hardy brothers maintained 60% of the company?s common shares. The company?s shares traded actively on the Alberta Stock Exchange. The share values have increased steadily along with the company profits. Historically, the shares have traded at 10 times the after-tax earnings per share?a value consistent with that of other public companies in the same industry. Last year, one of the brothers died. His estate has gradually disposed of his shares in Little Boy by selling them on the open market. This has left the remaining two brothers with 40% of the common shares. The remaining shares are widely held.

Not long ago, Joel Hardy, the president of Little Boy, received information that a particular investor was showing an unusual interest in the corporation?s shares and was quietly buying them in large blocks. After further investigation he discovered that the investor was a holding corporation owned by an individual with a history of taking over and liquidating corporate businesses.

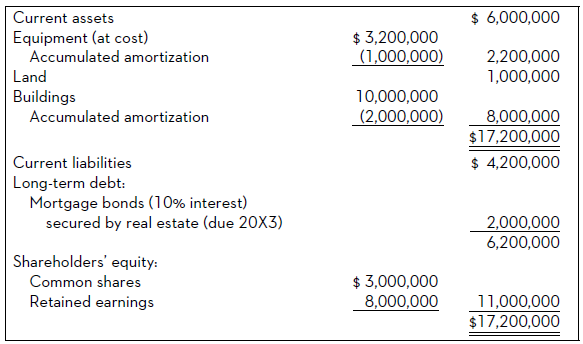

The most recent balance sheet of Little Boy is shown in Exhibit 1. Additional financial information is provided in Exhibit 2.

1. After-tax corporate profits for the current year amounted to $2,000,000. The corporate tax rate is 27%.

2. Amortization expense deducted in arriving at the above profit is as follows:

Equipment (12% straight line) ......................... $347,000Buildings (4% diminishing balance) .................. 320,000

3. The company occupies a total of 150,000 square feet of building space. Of this area, 10,000 square feet are leased at the current rental rate of $10 per square foot. This property was leased from a real estate investor who had purchased land and constructed a building according to the company?s specifications. The property had cost the investor $1,000,000. Little Boy is responsible for all expenses associated with the leased property. The remaining stores occupy space in buildings that are owned by Little Boy.

4. The undepreciated capital cost of the buildings for tax purposes is not significantly different from book value.

Required:

Analyze the financial information, and explain why Little Boy may be the target of a takeover bid.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Canadian Income Taxation 2018-2019

ISBN: 9781259464294

21st Edition

Authors: William Buckwold, Joan Kitunen