You are an Examiner for the Refund Integrity Program in the GST/HST Audit Division of the Canada

Question:

You are an Examiner for the Refund Integrity Program in the GST/HST Audit Division of the Canada Revenue Agency (CRA). Using sophisticated analytical tools, you are able to identify GST/HST returns that have a high risk of containing errors or omissions. You are currently working on a pre-assessment review for a GST/HST return filed by Kellogg Adelaide Ltd. (KAL) for its April 1?June 30, 20X6 reporting period.

The return was filed claiming a refund of $62,973. Using records accessible by the CRA, you are able to determine that KAL was incorporated on February 4, 20X6 and has not yet filed a corporate tax return. The company also registered a GST/HST account on April 25, 20X6 with an effective registration date of April 1. The period under review is KAL?s first GST/HST filing.

You have sent a pre-assessment review letter to the business address on file requesting a description of the commercial activity, a detailed general ledger of sales and input tax credits (ITCs), and copies of the five largest sales and purchasing invoices. KAL?s accounting controller has submitted the following information in response to your letter:

? KAL is engaged in the development and construction of a new residential condominium building at 9000 Adelaide Street in Toronto, Ontario. The parcel of land was purchased on April 25, 20X6 for $6,000,000. Revenue will come from the sales of the individual condominium units upon the building?s completion in 5 years.

? The only revenue in the period was a management fee of $25,000 received from Kellogg Yonge Street Inc. (KYSI), a corporation wholly owned by the same individual who owns KAL. No HST was charged on this fee by KAL and no ITC was claimed by KYSI since the parties have made a closely related group election. The controller was able to provide a copy of the completed election form.

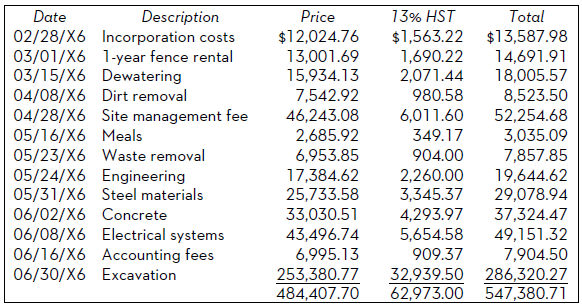

? The following breakdown was provided for the $62,973 of ITCs reported:

? The five largest supplier invoices were provided. For the site management fee invoice, the ?billed to? displays the name of KYSI. KAL?s controller explains that this particular vendor does work for both entities and incorrectly printed the wrong name on this invoice. The controller was able to provide proof of payment that the invoice was paid by KAL and not KYSI.

Required:

Determine what adjustments should be made to KAL?s GST/HST return and calculate the revised refund or balance owing. Be sure to explain your adjustments.

Step by Step Answer:

Canadian Income Taxation 2018-2019

ISBN: 9781259464294

21st Edition

Authors: William Buckwold, Joan Kitunen