Consider the following investment: There are zero taxes. If debt can be obtained at a cost of

Question:

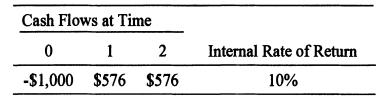

Consider the following investment:

There are zero taxes.

If debt can be obtained at a cost of 5 percent, determine the net present value ofthe equity cash flows discounted at 15 percent if

a. No debt is used to finance the investment.

b. $500 ofdebt is used to finance the investment.

c. $900 ofdebt is used to finance the investment.

Repeat the NPV calculations using 5 percent as the discount rate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: