Consider the probability distribution of the first year cash flows for the ABC Project: (a) Calculate the

Question:

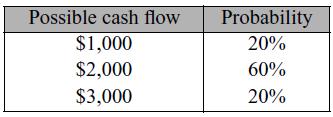

Consider the probability distribution of the first year cash flows for the ABC Project:

(a)

Calculate the range of possible cash flows (b)

Calculate the expected cash flow (c)

Calculate the standard deviation of the possible cash flows (d)

Calculate the coefficient of variation of the possible cash flowsLO3

Transcribed Image Text:

Possible cash flow Probability $1,000 20% $2,000 60% $3,000 20%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Hi, I am doing a project for derivatives class and I have some questions about a regression and Monte Carlo simulation that I need to come up with. So the goal is to hedge against CDS instruments by...

-

P8?3 Risk preferences Sharon Smith, the financial manager for Barnett Corporation, wishes to evaluate three prospective investments: X, Y, and Z. Sharon will evaluate each of these investments to...

-

Consider the probability distribution of the first year cash flows for the ABC Project: a. Calculate the range of possible cash flows. b. Calculate the expected cash flow. c. Calculate the standard...

-

QUESTION-3 (20 PTS): 3. What is a bond? Explain the relationship between bond interest rates and bond yields. Also briefly list the important parameters (variables) in a bond issuance/transaction?

-

Betty Cardinal runs Cardinals Book Shop in a downtown location. As her newly hired accountant, your task is to do the following (substituting HST at 13% for GST at 5% if your instructor so directs):...

-

For a population with a mean equal to 150 and a standard deviation equal to 30, calculate the standard error of the mean for a sample size of a. 10 b. 30 c. 50 AppendixLO1

-

Name the theories of fashion adoption and explain what they mean. LO.1

-

Deluca Solutions Inc. is an Ontario- based manufacturer. The company is listed on the TSX, but the family of founder David Deluca retains control through multiple- voting shares. Deluca undertook...

-

Lena Construction Company's projects extend over several years, and collection of receivables is reasonably certain. Each project has a contract that specifies a price and the rights and obligations...

-

If you put in $20,000 into a real-estate investment trust in 1999 (whose returns mimic the TSX Capped REIT Index in Table 9.1), what did your money grow to at the end 2010?

-

C Allen (a) The business of Allen is taken over by S$ Walters in its entirety. The assets are deemed to be worth the balance sheet values as shown. The price paid by Walters is 40,000. Show the...

-

Explain how the equilibrium, or market, price of a product is determined.

-

HW: Forces Begin Date: 9/24/2023 12:01:00 AM -- Due Date: 11/9/2023 11:59:00 PM End Date: 12/15/2023 11:59:00 PM (17%) Problem 4: A flea (of mass 6 10-7 kg) jumps by exerting a force of 1.45 10-5 N...

-

Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an installed cost of $87,000. Its useful life was estimated to...

-

Stock Valuation at Ragan Engines Larissa has been talking with the company's directors about the future of East Coast Yachts. To this point, the company has used outside suppliers for various key...

-

On January 1, 20X1, Elberta Company issued $50,000 of 4% convertible bonds, in total, into 5,000 shares of Elberta's common stock. No bonds were converted during 20X1. Throughout 20X1 Elberta had...

-

At Vision Club Company, office workers are employed for a 40-hour workweek and are quoted either a monthly or an annual salary (as indicated). Given on the form below are the current annual and...

-

Xerox's iGenX high-speed commercial printers cost $1.5 billion to develop. The machines cost $500,000 to $750,000 depending on what options the client selects. Spectrum Imaging Systems is considering...

-

Pearl Medavoy will invest $10,240 a year for 20 years in a fund that will earn 10% annual interest. . If the first payment into the fund occurs today, what amount will be in the fund in 20 years? If...

-

Portfolio return and beta Personal Finance Problem Jamie Peters invested $ 1 1 3 , 0 0 0 to set up the following portfolio one year ago: a . Calculate the portfolio beta on the basis of the original...

-

. Emerson Cammack wishes to purchase an annuity contract that will pay him $7,000 a year for the rest of his life. The Philo Life Insurance Company figures that his life expectancy is 20 years, based...

-

Integrity Inc. can sell 20-year, $1,000 par value bonds paying semi-annual interests with a 10% coupon. The bonds can be sold for $1,050 each; flotation cost of $50 per bond will be incurred in this...

Study smarter with the SolutionInn App