A petrochemical company is considering the purchase of a new serial production line to manufacture a new type of an engine oil; the company

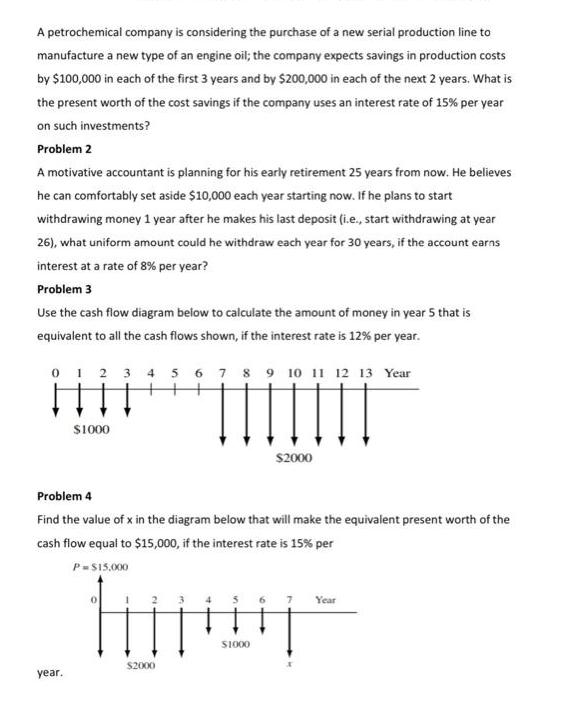

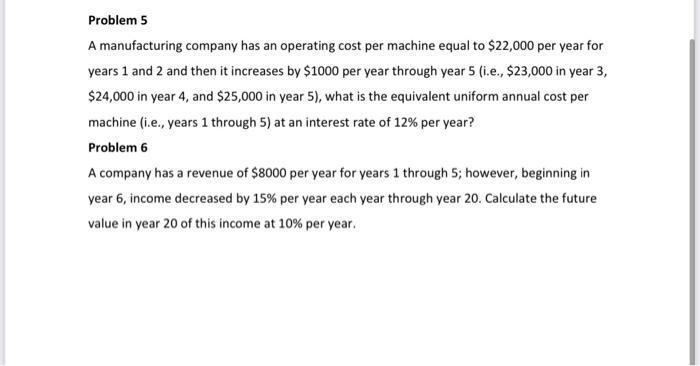

A petrochemical company is considering the purchase of a new serial production line to manufacture a new type of an engine oil; the company expects savings in production costs by $100,000 in each of the first 3 years and by $200,000 in each of the next 2 years. What is the present worth of the cost savings if the company uses an interest rate of 15% per year on such investments? Problem 2 A motivative accountant is planning for his early retirement 25 years from now. He believes he can comfortably set aside $10,000 each year starting now. If he plans to start withdrawing money 1 year after he makes his last deposit (i.e., start withdrawing at year 26), what uniform amount could he withdraw each year for 30 years, if the account earns interest at a rate of 8% per year? Problem 3 Use the cash flow diagram below to calculate the amount of money in year 5 that is equivalent to all the cash flows shown, if the interest rate is 12% per year. 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Year $1000 year. Problem 4 Find the value of x in the diagram below that will make the equivalent present worth of the cash flow equal to $15,000, if the interest rate is 15% per P = $15,000 $2000 $2000 $1000 7 Year Problem 5 A manufacturing company has an operating cost per machine equal to $22,000 per year for years 1 and 2 and then it increases by $1000 per year through year 5 (i.e., $23,000 in year 3, $24,000 in year 4, and $25,000 in year 5), what is the equivalent uniform annual cost per machine (i.e., years 1 through 5) at an interest rate of 12% per year? Problem 6 A company has a revenue of $8000 per year for years 1 through 5; however, beginning in year 6, income decreased by 15% per year each year through year 20. Calculate the future value in year 20 of this income at 10% per year.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 To calculate the present worth of the cost savings we need to determine the present worth of each years savings and then sum them up Using an interest rate of 15 per year we can calculate th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started