1. Open the general ledger accounts and accounts receivable ledger accounts indicated below. 2. Post the entries...

Question:

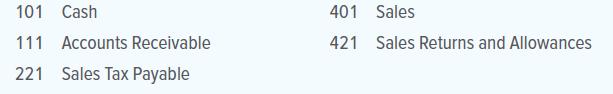

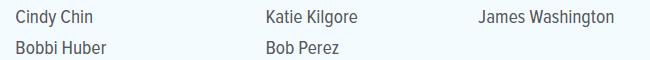

1. Open the general ledger accounts and accounts receivable ledger accounts indicated below.

2. Post the entries from the general journal in Problem 7.2A to the appropriate accounts in the general ledger and in the accounts receivable ledger.

3. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

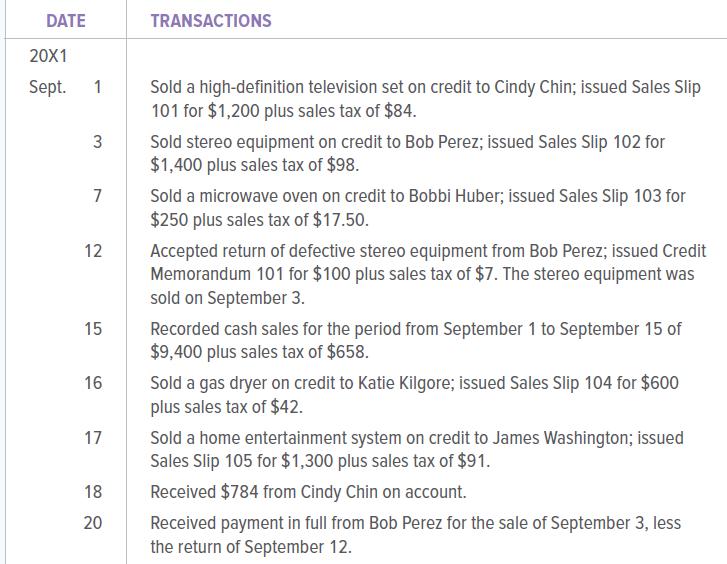

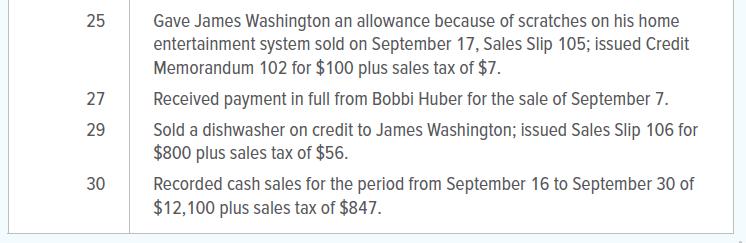

Data from in Problem 7.2A

Precision Electronics began operations September 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. The terms for all sales on credit are net 30. During September, Precision Electronics engaged in the following transactions:

GENERAL LEDGER ACCOUNTS

ACCOUNTS RECEIVABLE LEDGER ACCOUNTS

Analyze:

What is the amount of sales tax owed at September 30, 20X1?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina