The following transactions took place at Animal World Amusement Park during May. Animal World Amusement Park must

Question:

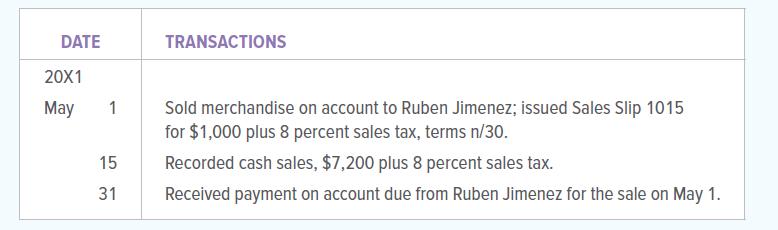

The following transactions took place at Animal World Amusement Park during May. Animal World Amusement Park must charge 8 percent sales tax on all sales.

Transcribed Image Text:

DATE 20X1 May 1 15 31 TRANSACTIONS Sold merchandise on account to Ruben Jimenez; issued Sales Slip 1015 for $1,000 plus 8 percent sales tax, terms n/30. Recorded cash sales, $7,200 plus 8 percent sales tax. Received payment on account due from Ruben Jimenez for the sale on May 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 35% (17 reviews)

May 1 Debit Accounts Receivable Ruben Jimenez 1...View the full answer

Answered By

Hande Dereli

Enthusiastic tutor, skilled in ACT and SAT tutoring. Raised one student's score on the SATs from 1100 combined to 1400. Graduated with a 3.9 GPA from Davidson College and led a popular peer tutoring group for three years. Scored in the top 0.06% in the nation on the SATs. The real reason I'm the one to help you nail the test? Results. Clients invariably praise my ability to listen and communicate in a low-stress, fun way. I think it's that great interaction that lets me raise retest SAT scores an average of 300 points.

0.00

0 Reviews

10+ Question Solved

Related Book For

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina

Question Posted:

Students also viewed these Business questions

-

The following transactions took place at Five Flags Amusement Park during May. Five Flags Amusement Park must charge 8 percent sales tax on all sales: DATE TRANSACTIONS 2019 May 1 Sold merchandise on...

-

The following transactions took place at Swensons Wildlife Resort during May. Swensons Wildlife Resort must charge 8 percent sales tax on all sales: DATE TRANSACTIONS 2016 May 1 Sold merchandise on...

-

The following transactions took place at Hanson's Wildlife Resort during May. Hanson's Wildlife Resort must charge 8 percent sales tax on all sales: DATE TRANSACTIONS 2013 May 1 Sold merchandise on...

-

Since the introduction of enhanced security measures by the U.S. Department of Homeland Security in 2017, flights bound for the U.S. from Canada are subject to additional screening by airline...

-

How does your city sequence/schedule snow plowing?

-

The accompanying data on degree of spirituality for samples of natural and social scientists at research universities as well as for a sample of non-academics with graduate degrees appeared in the...

-

Effect of altitude on climbers. Dr. Philip Lieberman, a neuroscientist at Brown University, conducted a field experiment to gauge the effect of high altitude on a persons ability to think critically....

-

You are an audit supervisor assigned to a new client, Go-Go Corporation, which is listed on the New York Stock Exchange. You visited Go-Gos corporate headquarters to become acquainted with key...

-

Problem 13-4A Calculation of financial statement ratios LO P3 Selected year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December...

-

Read the following cases. For each, state whether the action or situation shows a violation of the AICPA Code of Professional Conduct; if so, explain why and cite the relevant rule or interpretation....

-

1. Open the general ledger accounts and accounts receivable ledger accounts indicated below. 2. Post the entries from the general journal in Problem 7.2A to the appropriate accounts in the general...

-

Appliances Unlimited began operations November 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, Appliances Unlimited...

-

The following records of Hallmark Electronic Repair are presented in the working papers: Journal containing entries for the period May 131. Ledger to which the May entries have been posted. ...

-

San Antonio S.A. rents a store in the Cusco Shopping Center, carrying out a series of modifications and installations in said store with the commitment that, at the end of the rental, it will...

-

b. If the above transactions covered a full year's operations, prepare a journal entry to dispose of the overhead account balance. Assume that the balance is significant. Also assume that the...

-

On 1 May 2015 Harry's Plastics Ltd acquires goods from a supplier in the US. The goods are shipped f.o.b. from the United States on 1 May 2015. The cost of the goods is US$1 500 000. The amount has...

-

In this assignment, you are going to analyze the financial viability of two companies, currently listed on the TSX . Then you will make an investment decision and justify your reasoning. Email your...

-

Create a journal entry for expense closing enteries. Time period: 3 months Entry number HBS073 This journal entry have 13 accounts Income Statement Weeks 1-10 Total Revenue Rental Revenue Sales...

-

Evaluate the binomial coefficient.

-

Linda Lopez opened a beauty studio, Lindas Salon, on January 2, 2011. The salon also sells beauty supplies. In January 2012, Lopez realized she had never filed any tax reports for her business and...

-

The accounting system of Rose and Tea Fine Kitchenware includes the following journals. Indicate which journal is used to record each transaction. JOURNALS Cash receipts journal Cash payments journal...

-

The balances of certain accounts of Camille Corporation on April 30, 20X1, were as follows: Sales $ 330,000 Sales Returns and Allowances 4,500 The firms net sales are subject to an 8 percent sales...

-

Olivers English Gardens, a wholesale firm, made sales using the following list prices and trade discounts. What amount will be recorded for each sale in the sales journal? 1. List price of $7,000 and...

-

Question 3 (24 marks) Wonderful Technology Company Limited sells computers and accessories. Data of the store's operations are as follow: Sales are budgeted at $400,000 for December 2019, $420,000...

-

Kratz Manufacturing Company uses an activity-based costing system. It has the following manufacturing activity areas, related cost drivers and cost allocation rates: Activity Cost Driver Cost...

-

You are a Partner with Fix-It Consultants and have been engaged in an advisory capacity with a software company, called MoveFast. The company is seeing a sharp decline in revenue, with the primary...

Study smarter with the SolutionInn App