Aya Antoun, owner of Antouns Stencilling Service in Grande Prairie, has requested that you prepare from the

Question:

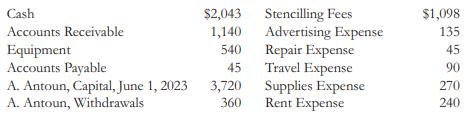

Aya Antoun, owner of Antoun’s Stencilling Service in Grande Prairie, has requested that you prepare from the following balances

(a) An income statement for June 2023.

(b) A statement of owner’s equity for June.

(c) A balance sheet as of June 30, 2023.

Transcribed Image Text:

Cash Accounts Receivable Equipment Accounts Payable A. Antoun, Capital, June 1, 2023 A. Antoun, Withdrawals $2,043 1,140 540 45 3,720 360 Stencilling Fees Advertising Expense Repair Expense Travel Expense Supplies Expense Rent Expense $1,098 135 45 90 270 240

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a b c Revenue Stencilling Fees Operating Expenses Advertis...View the full answer

Answered By

Muhammad Haroon

More than 3 years experience in teaching undergraduate and graduate level courses which includes Object Oriented Programming, Data Structures, Algorithms, Database Systems, Theory of Automata, Theory of Computation, Database Administration, Web Technologies etc.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good

Question Posted:

Students also viewed these Business questions

-

A comparative balance sheet and an income statement for Blankley Company are given below: Blankley Company Income Statement (dollars in millions) Sales . . . . . . . . . . . . . . . . . . . . . . . ....

-

A comparative balance sheet and an income statement for Burgess Company are given below: Burgess also provided the following information: 1. The company sold equipment that had an original cost of $...

-

Prepare in good form an income statement for Franklin Kite Co. Inc. Take your calculations all the way to computing earnings per share. Sales $900,000 Shares outstanding 50,000 Cost of goods sold...

-

Based on the following definitions, which statement is NOT true? int[] 1DArray={1,2,3}; int[][] 2DArray=new int[2][]; 2DArray[0]={4,5}; 2DArray[1]={6,7,8}; public void method1(int[] 1DArray){...}...

-

According to a utility company, utility plant expenditures per employee were approximately $50,845, $43,690, $47,098, $56,121, and $49,369 for the years 2005 through 2009. Employees at the end of...

-

A company will begin stocking remote control devices. Expected monthly demand is 800 units. The controllers can be purchased from either supplier A or supplier B. Their price lists are as follows:...

-

Who is Ashley Stewarts target market? Could/should that target market be expanded? Ashley Stewart43 An auditorium full of graduate and undergraduate students was eager to hear what James Rhee, the...

-

1. What would you do if you were Stefan? What if you were Dillon? 2. What advice would you offer to Stefan and Dillon to maintain strong family relationships?

-

QUESTION 15 Portfolio X has a weighted beta coefficient of 1.5 and Portfolio Y has a weighted beta coefficient of 0.8. Both portfolios are expected to earn the same weighted average expected return....

-

Were the payments to Alan protected by the business judgment rule? Years ago, Harry Lippman purchased Despatch Industries, Inc., which manufactured hardware for cabinets. His son, James, worked for...

-

From the following account balances for June 2022, prepare in proper form (a) An income statement, (b) A statement of owners equity, and (c) A balance sheet for French Realty Cash Accounts Receivable...

-

Many accounting professionals work in one of the following areas: a. Financial accounting b. Managerial accounting c. Taxation accounting d. Other accounting related activities For each of the...

-

Compute and use operating leverage factor (Learning Objective 5) Suppose Kay sells 800 posters. Use the original data ( \(\$ 35\) sales price, \(\$ 21\) variable cost, \(\$ 7,000\) fixed expenses) to...

-

Sams old friend Dot is considering setting up a business offering historical boating trips along the River Thames. Dot thinks that she may be able to make a good living out of this. She has carried...

-

Arrow Industries employs a standard cost system in which direct materials inventory is carried at standard cost. Arrow has established the following standards for the direct costs of one unit of...

-

Explain the financial effect (increase, decrease, or no effect) of each of the following transactions on stockholders' equity: a. Purchased supplies for cash. b. Paid an account payable. c. Paid...

-

What type of account-asset, liability, stockholders' equity, dividend, revenue, or expense-is each of the following accounts? Indicate whether a debit entry or a credit entry increases the balance of...

-

Is it possible for an accounting transaction to only affect the left side of the accounting equation and still leave the equation in balance? If so, provide an example.

-

Fill in the blanks with an appropriate word, phrase, or symbol(s). Given the conditional statement p q, the contrapositive of the conditional statement in symbolic form is

-

Identify the most stable compound:

-

If, in exercise E8-2A, cash on hand was $13, prepare the entry to replenish the petty cash on July 31. Data From exercise E8-2A In general journal form, prepare journal entries to establish a petty...

-

Identify whether each of the following items affects the bank or book side of the reconciliation, and indicate whether the amount represents an addition or a subtraction. Bank or Book + or - a....

-

Explain the end product of a bank reconciliation.

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App