Given the following amounts in these accounts below, journalize the adjusting entry for bad debts expense on

Question:

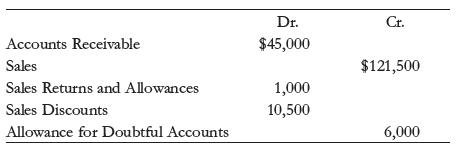

Given the following amounts in these accounts below, journalize the adjusting entry for bad debts expense on December 21, 2021. Bad Debt Expense is estimated to be 5% of net sales. The income statement approach is used.

Transcribed Image Text:

Accounts Receivable Sales Sales Returns and Allowances Sales Discounts Allowance for Doubtful Accounts Dr. $45,000 1,000 10,500 Cr. $121,500 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

Date Account Title and Descrip...View the full answer

Answered By

Chandravathana Ilanthirayan

With Masters in Computer Science Engineering I have handled various subjects like Basics of Programming, Operating Systems, Computer Architecture, Adhoc and Sensor Networks. Have produced best results twice in Operating Systems & Adhoc and Sensor Networks. Produced best performers in labs handled and was also awarded the best performer award in Software Engineering lab during my Bachelor’s degree. I can teach the subjects under computer science comprehensibly and easily so that the students get the conceptions clearly.

0.00

0 Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good

Question Posted:

Students also viewed these Business questions

-

The security market line is estimated to be k = 5% 1 110.4% - 5%2b. You are considering two stocks. The beta of A is 1.4. The firm offers a dividend yield during the year of 4 percent and a growth...

-

The beta of company As stock is estimated to be 1.2 according to the regression analysis. Assume that the prevailing risk-free rate is 6 percent, and the market risk premium is estimated to be 7...

-

The records of Alyssa Company show the following amounts in its December 31 financial statements: Alyssa Company made the following errors in determining its ending inventory : 1. The ending...

-

A scholarship recipient may exclude from gross income the scholarship proceeds received for: Tuition, housing, and meals. O Tuition, books, and supplies. O Meals but not housing. O Meals and housing,...

-

If glass is dispersive, why dont we normally see a spectrum of colors when sunlight passes through a glass window? Explain. (Are the speeds of each color of light the same in the glass?)

-

How would you evaluate the success of your training program?

-

What is diversity? AppendixLO1

-

Manufacturing data for June and July in the Blending Department of Laurence Liquids Inc. follow: All materials are added at the start of the process. Labor and factory overhead are added evenly...

-

Cougar Corp.'s balance sheet includes the following asset: Equipment................................................... $95,000 Less: accumulated depreciation................... (25,000) Book value...

-

How much depreciation is reported by Philadelphia Region 3 on assets purchased from Magellanic Resources? How much depreciation is reported by Kansas City Region 7 on assets purchased from Magellanic...

-

Given the information below, and assuming the following balances: Cash, $42,000; Accounts Receivable, $173,000; Allowance for Doubtful Accounts, $400 credit; Inventory, $12,000: a. Prepare on...

-

Given the additional data in the table below: a. Prepare the adjusting journal entry for bad debts expense on December 31, 2021. b. Prepare a partial balance sheet on December 31, 2021, showing how...

-

On a map of Hawaii, 1.3 in. represents 20.0 mi. If the distance on the map between Honolulu and Kaanapali on Maui is 6.0 in., how far is Kaanapali from Honolulu?

-

IRIS Ratio Analysis Spreadsheet Using the information presented below, calculate the ratios requested in the IRIS ratio section. All of your answers should be in percentage-format. Note that the...

-

https://www.youtube.com/watch?v=jQbXao0mQ1M 1. Identify the cultural misunderstandings that occurred during Kenichi Takahashi's meeting with Rob, Ella, and Stephanie. Explain and support your...

-

Using what you know of groups and teams, how do you get your teams back on track with Pat? What actions do you need to take as a leader to minimize/repair the negative impact Pat's has had on the...

-

The demand function for a certain product is given by p = 3000 2x + 100 (0 x 10) where x (measured in units of a thousand) is the quantity demanded per week and p is the unit price in dollars. Sketch...

-

QUESTION 4 Dr. Martin Luther King's Speech where he proclaimed, "Free at last! Free at last!" is an example of O A. Impromptu O B. Dissolving OC. Prepared D. Reference E.Planned Speaking Wording...

-

Starting with Eq. (3.32), prove that the energy densities of the electric and magnet fields are equal (u E = u B ) for an electromagnetic wave. (3.32) UB 2o

-

For each equation, (a) Write it in slope-intercept form (b) Give the slope of the line (c) Give the y-intercept (d) Graph the line. 7x - 3y = 3

-

The following transactions of Jacks Auto Supply occurred in November (Balances as of November 1 are given for general ledger and accounts receivable ledger accounts: Danielson $400 Dr.; Wallace $550...

-

Mike Patten owns Pattens Sneaker Shop. (Balances as of May 1 are provided for the accounts receivable and general ledger accounts as follows: Donati $375 Dr.; Lindall $850 Dr.; Pilar $550 Dr.; Zamora...

-

Mike Patten owns Pattens Sneaker Shop. (Balances as of May 1 are provided for the accounts receivable and general ledger accounts as follows: Donati $375 Dr.; Lindall $850 Dr.; Pilar $550 Dr.; Zamora...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

Study smarter with the SolutionInn App