Given the information below, and assuming the following balances: Cash, $42,000; Accounts Receivable, $173,000; Allowance for Doubtful

Question:

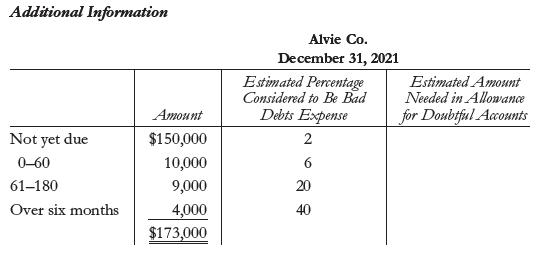

Given the information below, and assuming the following balances: Cash, $42,000; Accounts Receivable, $173,000; Allowance for Doubtful Accounts, $400 credit; Inventory, $12,000:

a. Prepare on December 31, 2021, the adjusting journal entry for bad debts expense.

b. Prepare a partial balance sheet on December 31, 2021, showing how net realizable value is calculated.

c. If the balance in Allowance for Doubtful Accounts were a $400 debit balance, journalize the adjusting entry for bad debts expense on December 31, 2021.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good

Question Posted: