The first 9 months of the year have concluded for Suarez Digital Services. Sid Suarez wants to

Question:

The first 9 months of the year have concluded for Suarez Digital Services. Sid Suarez wants to make the necessary adjustments to his accounts to prepare accurate financial statements for the last 6 months ending on March 31, 202Y.

Assignment

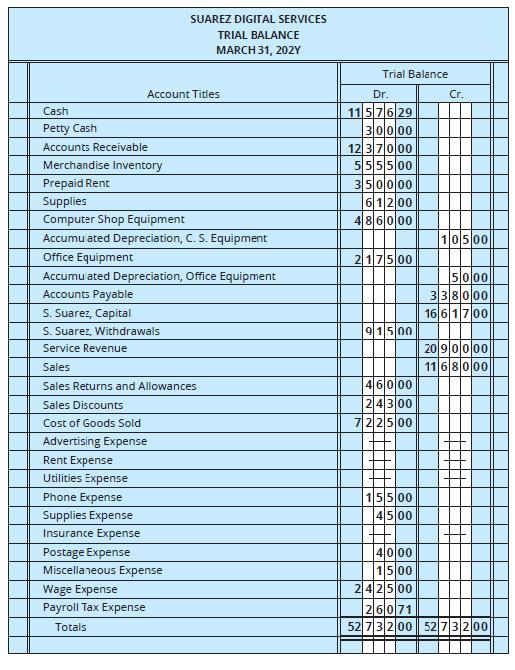

To prepare these adjustments, use the trial balance in Figure 11.17 and the following inventory that Sid took at the end of March:

Supplies

15 dozen ¼-inch screws at a cost of $15 a dozen

8 dozen ½-inch screws at a cost of $10 a dozen 4 feet of coaxial cable at a cost of $8 per foot

4 feet of coaxial cable at a cost of $8 per foot

Merchandise Inventory

A physical inventory taken on March 31 indicated that Merchandise Inventory remaining in stock was valued at $200.

Depreciation of Computer Equipment

Computer depreciates at $35 a month; purchased July 5.

Computer workstations depreciate at $35 per month; purchased September 17.

Shop benches depreciate at $30 per month; purchased November 5.

Depreciation of Office Equipment

Office equipment depreciates at $25 per month; purchased July 17.

Fax machine depreciates at $15 per month; purchased November 20.

Remember: If any long-term asset is purchased in the first 15 days of the month,

Suarez will charge depreciation for the full month. If an asset is purchased later than the 15th, he will not charge depreciation in the month it was purchased.

Expiration of Prepaid Rent

Six months’ worth of rent at a rental rate of $500 per month has expired.

Complete the 10-column worksheet for the 6 months ended March 31, 202Y.

Step by Step Answer:

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780137504282

15th Edition

Authors: Jeffrey Slater, Mike Deschamps