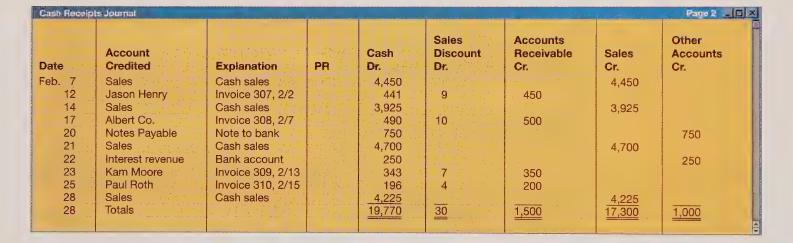

Assume the transactions in Exercise 11-5 involve cash sales instead of credit sales. Also assume that the

Question:

Assume the transactions in Exercise 11-5 involve cash sales instead of credit sales. Also assume that the Keeler company receives interest revenue on June 17 of \($350\) from the bank and receives a loan of \($2,000\) on June 23 from the bank. Prepare headings for a cash receipts journal like the one in Exhibit 11.10. Prepare a cash receipts journal for these cash receipts during the month of June.

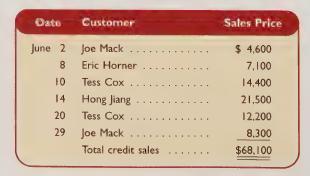

Exercise 11-5:

Accounts receivable ledger; posting from sales journal Keeler Company had the following credit sales to its customers during June.

Required

I. Open an accounts receivable subsidiary ledger having a T-account for each customer. Post the invoices to the subsidiary ledger. Ignore sales tax.

2. Open an Accounts Receivable controlling T-account and a Sales T-account to reflect general ledger accounts. The Accounts Receivable controlling account has a zero balance on June 1. Post the end-of-month total from the sales journal to these accounts.

3. Prepare a schedule of accounts receivable as of June 30 and prove that its total equals the Accounts Receivable controlling account balance on June 30.

Exhibit 11.10:

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw