Question: JIT purchasing, relevant benefits, relevant costs. (CMA, adapted) The Margro Corporation is an automotive supplier that uses automatic turning machines to manufacture precision parts from

JIT purchasing, relevant benefits, relevant costs. (CMA, adapted) The Margro Corporation is an automotive supplier that uses automatic turning machines to manufacture precision parts from steel bars. Margro’s inventory of raw steel averages $600,000. John Dates, president of Margro, and Helen Gorman, Margro’s controller, are concerned about the costs of carrying inventory. The steel supplier is willing to supply steel in smaller lots at no additional charge. Gorman identifies the following effects of adopting a JIT inventory program to virtually eliminate steel inventory:

- Without scheduling any overtime, lost sales due to stockouts would increase by 35,000 units per year However, by incurring overtime premiums of $40,000 per year, the increase in lost sales could be reduced to 20,000 units per year This would be the maximum amount of overtime that would be feasible for Margro.

- Two warehouses currently used for steel bar storage would no longer be needed. Margro rents one warehouse from another company under a cancelable leasing arrangement at an annual cost of $60,000. The other warehouse is owned by Margro and contains 12,000 square feet Three-fourths of the space in the owned warehouse could be rented for $1.50 per square foot per year. Insurance and property tax costs totaling $14,000 per year would be eliminated.

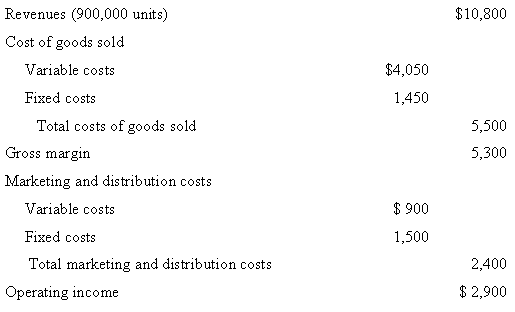

Margro’s required rate of return on investment is 20% per year Margro’s budgeted income statement for the year ending December 31, 2008 (in thousands) is as follows:

1. Calculate the estimated dollar savings (loss) for the Margro Corporation that would result in 2008 from the adoption of JIT purchasing.

2. Identify and explain other factors that Margro should consider before deciding whether to adopt JIT purchasing.

Revenues (900,000 units) $10,800 Cost of goods sold Variable costs $4,050 Fixed costs 1,450 Total costs of goods sold 5,500 Gross margin 5,300 Marketing and distribution costs $ 900 Variable costs 1,500 Fixed costs Total marketing and distribution costs 2,400 $ 2,900 Operating income

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

JIT purchasing relevant benefits relevant costs 1 Solution Exhibit 2031 presents the 37500 cash savings that would result if Margro Corporation adopte... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-P-A (259).docx

120 KBs Word File