Rainmaker prepares adjustments each October 31. The following additional information is available on October 31, 2020. a. It was determined that $11,200 of the

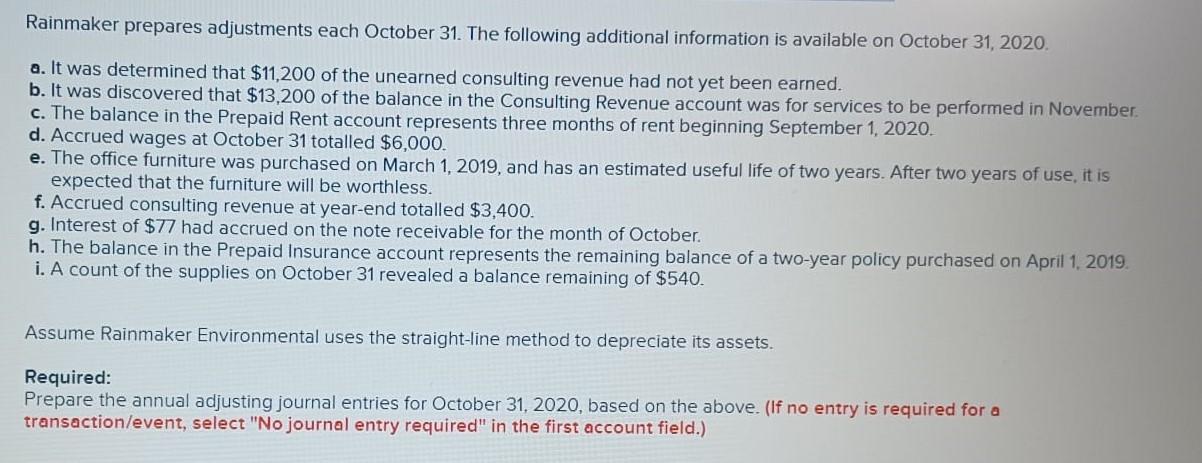

Rainmaker prepares adjustments each October 31. The following additional information is available on October 31, 2020. a. It was determined that $11,200 of the unearned consulting revenue had not yet been earned. b. It was discovered that $13,200 of the balance in the Consulting Revenue account was for services to be performed in November. c. The balance in the Prepaid Rent account represents three months of rent beginning September 1, 2020. d. Accrued wages at October 31 totalled $6,000. e. The office furniture was purchased on March 1, 2019, and has an estimated useful life of two years. After two years of use, it is expected that the furniture will be worthless. f. Accrued consulting revenue at year-end totalled $3,400. g. Interest of $77 had accrued on the note receivable for the month of October. h. The balance in the Prepaid Insurance account represents the remaining balance of a two-year policy purchased on April 1, 2019. i. A count of the supplies on October 31 revealed a balance remaining of $540. Assume Rainmaker Environmental uses the straight-line method to depreciate its assets. Required: Prepare the annual adjusting journal entries for October 31, 2020, based on the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting journal entry for October 31 2020 1 Dr Consulting Revenue 11200 Cr U...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started