Question:

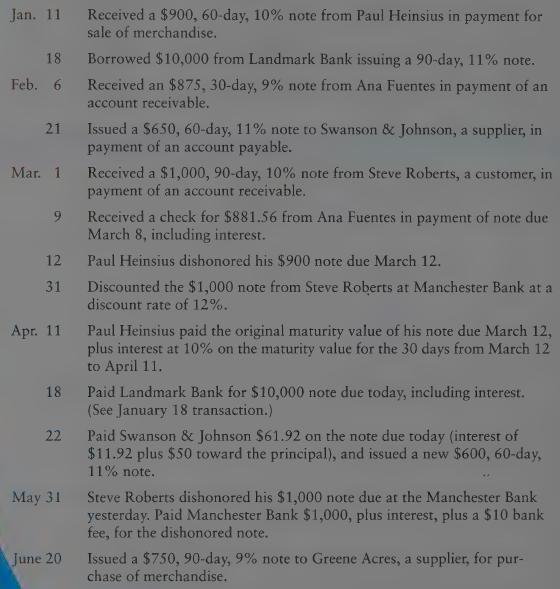

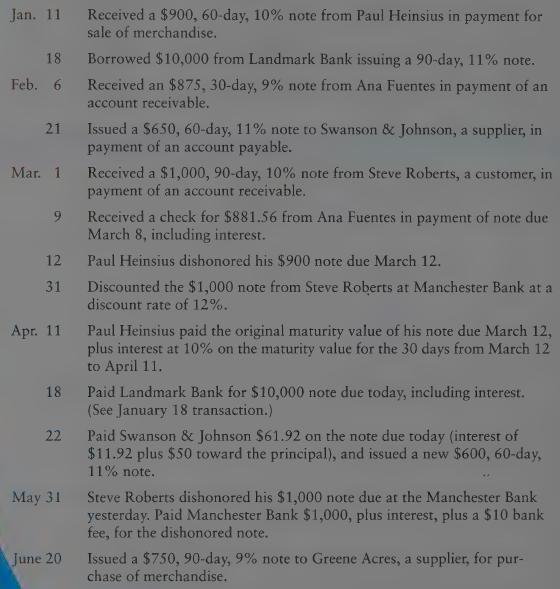

Barbar Brothers, partners in a wholesale hardware business, completed the following transactions involving notes and interest during the first half of 20--:

REQUIRED Record each transaction in a general journal.

Transcribed Image Text:

Jan. 11 18 Feb. 6 21 Mar. 1 9 12 31 Apr. 11 18 22 May 31 June 20 Received a $900, 60-day, 10% note from Paul Heinsius in payment for sale of merchandise. Borrowed $10,000 from Landmark Bank issuing a 90-day, 11% note. Received an $875, 30-day, 9% note from Ana Fuentes in payment of an account receivable. Issued a $6.50, 60-day, 11% note to Swanson & Johnson, a supplier, in payment of an account payable. Received a $1,000, 90-day, 10% note from Steve Roberts, a customer, in payment of an account receivable. Received a check for $881.56 from Ana Fuentes in payment of note due March 8, including interest. Paul Heinsius dishonored his $900 note due March 12. Discounted the $1,000 note from Steve Roberts at Manchester Bank at a discount rate of 12%. Paul Heinsius paid the original maturity value of his note due March 12, plus interest at 10% on the maturity value for the 30 days from March 12 to April 11. Paid Landmark Bank for $10,000 note due today, including interest. (See January 18 transaction.) Paid Swanson & Johnson $61.92 on the note due today (interest of $11.92 plus $50 toward the principal), and issued a new $600, 60-day, 11% note. Steve Roberts dishonored his $1,000 note due at the Manchester Bank yesterday. Paid Manchester Bank $1,000, plus interest, plus a $10 bank fee, for the dishonored note. Issued a $750, 90-day, 9% note to Greene Acres, a supplier, for pur- chase of merchandise.