Use the following data to calculate the requested ratios for Tristar Transport and Logistic Services. Briefly analyse each answer. 1) Days accounts receivable. 2)

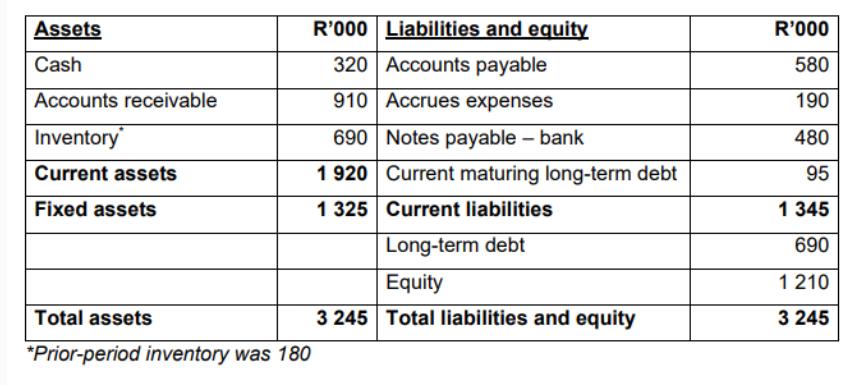

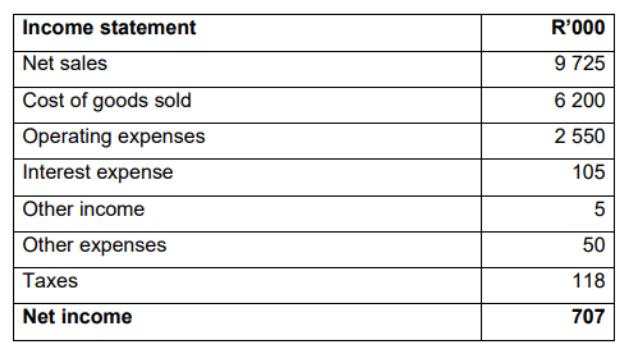

Use the following data to calculate the requested ratios for Tristar Transport and Logistic Services. Briefly analyse each answer. 1) Days accounts receivable. 2) Inventory turnover. 3) Debt/equity. 4) Total asset turnover (asset utilisation). 5) Finance cost-to-sales ratio. Assets Cash R'000 Liabilities and equity R'000 320 Accounts payable 580 Accounts receivable 910 Accrues expenses 190 Inventory 690 Notes payable - bank 480 Current assets 1 920 Current maturing long-term debt 95 Fixed assets 1 325 Current liabilities 1345 Total assets *Prior-period inventory was 180 Long-term debt Equity 3 245 Total liabilities and equity 690 1 210 3 245 Income statement R'000 Net sales 9 725 Cost of goods sold 6 200 Operating expenses 2 550 Interest expense 105 Other income Other expenses Taxes Net income 5 50 118 707

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the given financial ratios lets use the provided balance sheet and income statement We will go stepbystep through each calculation and provide a realtime example for better understanding 1 Da...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started