Computing and reporting unemployment taxes Ideal Systems employees had the following earnings records at the close of

Question:

Computing and reporting unemployment taxes

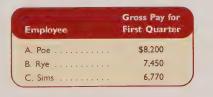

Ideal Systems’ employees had the following earnings records at the close of the first quarter:

The state unemployment tax is 5.4%, but Ideal Systems pays only 2% due to its high merit rating. Ideal Systems also pays 0.8% for federal unemployment taxes. Unemployment taxes are based on the first \($7,000\) of each employee’s earnings during the year.

1. Compute Ideal Systems’ SUTA and FUTA tax liabilities for the first quarter.

2. Prepare the general journal entry to record Ideal Systems’ SUTA and FUTA tax liabilities for the first quarter.

3. Prepare the general journal entry to record Ideal Systems’ payment of its SUTA and FUTA tax liabilities for the first quarter.

4. Explain how Ideal Systems will report its unemployment taxes to the state and federal governments.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw