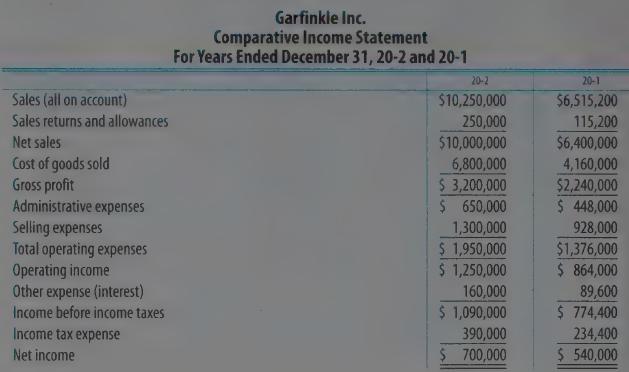

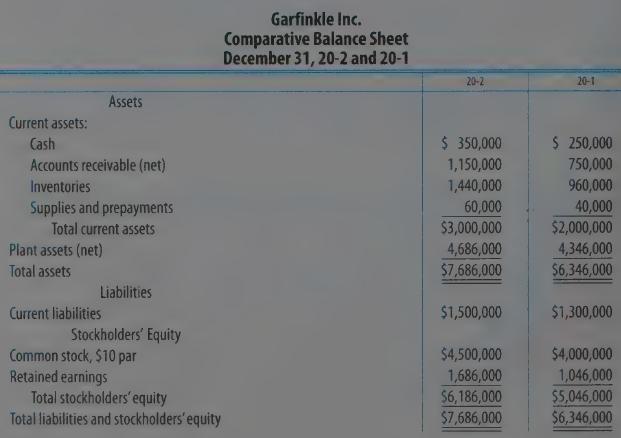

Garfinkle Inc.s comparative financial statements for the years ending December 31, 20-2 and 20-1, are shown below.

Question:

Garfinkle Inc.’s comparative financial statements for the years ending December 31, 20-2 and 20-1, are shown below.

REQUIRED 1. Prepare a horizontal analysis of Garfinkle’s comparative income statement for 20-2 and 20-1.

Prepare a vertical analysis of Garfinkle’s comparative income statement for 20-2 and 20-1.

Prepare a horizontal analysis of Garfinkle’s comparative balance sheet for 20-2 and 20-1.

Prepare a vertical analysis of Garfinkle’s comparative balance sheet for 20-2 and 20-1.

Determine the following measures for 20-2 (round all calculations to two decimal places):

a) working capital

b) current ratio

c) quick ratio

d) accounts receivable turnover

e) average collection period for accounts receivable

f) merchandise inventory turnover g) average number of days required to sell merchandise inventory h) ratio of net sales to assets i) return on total assets j) return on common stockholders’ equity k) earnings per share of common stock l) book value per share of common stock m) ratio of liabilities to stockholders’ equity n) times interest earned ratio

Step by Step Answer: