Harris Insurance Agency has the following information for the week ended December 14: Assumed tax rates are

Question:

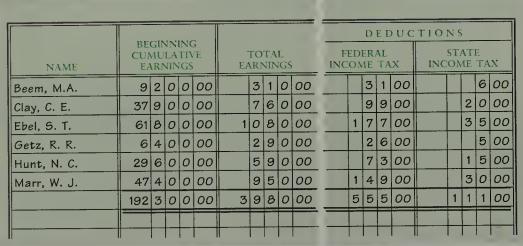

Harris Insurance Agency has the following information for the week ended December 14:

Assumed tax rates are as follows:

a. FICA: Social Security, 6.2 percent (.062) on the first $62,700 for each employee and Medicare, 1.45 percent (.0145) on all earnings for each employee.

b. State unemployment tax, 5.4 percent (.054) on the first $7,000 for each employee.

c. Federal unemployment tax, .8 percent (.008) on the first $7,000 for each employee.

Instructions 1. Complete the payroll register, page 72.

2. Prepare a general journal entry to record the payroll as of December 14. The company’s general ledger contains a Salary Expense account and a Salaries Payable account.

3. Prepare a general journal entry to record the payroll taxes as of December 14.

4. Assuming that the firm uses a special payroll bank account, make the entries in t’ e general journal to record the transfer of cash to the Cash-Payroll Bank Act lunt and the payment of salaries, Ck. No. 317, on December 16. Payroll chec s begin within Ck. No. 923 in the payroll register.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille