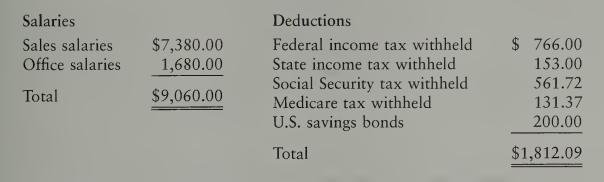

Hirsch and Company had the following payroll for the week P.0.1 ended March 21: Salaries Sales salaries

Question:

Hirsch and Company had the following payroll for the week P.0.1 ended March 21:

Salaries Sales salaries $7,380.0

Assumed tax rates are as follows:

a. FICA: Social Security, 6.2 percent (.062) on the first $62,700 for each employee and Medicare, 1.45 percent (.0145) on all earnings for each employee.

b. State unemployment tax, 5.4 percent (.054) on the first $7,000 for each employee.

c. Federal unemployment tax, .8 percent (.008) on the first $7,000 for each employee.

Instructions Record the following entries in general journal form:

1. The payroll entry as of March 21, assuming that Hirsch uses a payroll bank account.

2. The entry to record the employer’s payroll taxes as of March 21, assuming that the total payroll is subject to the FICA tax (combined Social Security and Medicare) and that $3,940 is subject to unemployment taxes.

3. The entry to transfer cash to the Cash-Payroll Bank Account on March 23.

4. The payment of the employees on March 23.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille