The Lacey Company has the following balances in its general P.0.1,2,3 ledger as of June 1 of

Question:

The Lacey Company has the following balances in its general P.0.1,2,3 ledger as of June 1 of this year:

a. FICA Tax Payable (liability for May), $1,706.56.

b. Employees’ Federal Income Tax Payable (liability for May), $976.

c. Federal Unemployment Tax Payable (liability for April and May), $178.46.

d. State Unemployment Tax Payable (liability for April and May), $1,204.64.

e. Employees’ Medical Insurance Payable (liability for April and May), $1,240.

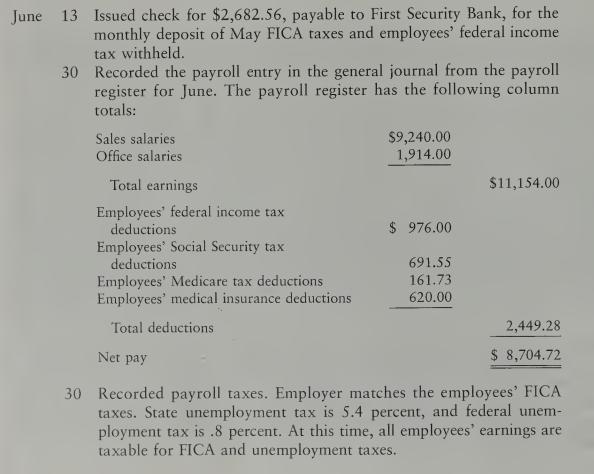

The company completed the following transactions involving the payroll dur¬

ing June and July:

Issued check payable to the Cash-Payroll Bank Account.

Issued check for $8,704.72 from the Cash-Payroll Bank Account to pay salaries for the month.

Issued check for $1,860, payable to Caring Insurance Company, in payment of employees’ medical insurance for April, May, and June.

Issued check for $2,682.56, payable to First Security Bank, for the monthly deposit of June FICA taxes and employees’ federal income tax withheld.

Issued check for $1,806.96, payable to the State Tax Commission, for state unemployment tax for April, May, and June. The check was accompanied by the quarterly tax return.

Issued check for $267.69, payable to First Security Bank, for the deposit of federal unemployment tax for the months of April, May, and June.

Instructions Record the transactions in the general journal, page 77.

Instructions for General Ledger Software 1. Record the transactions in the general journal.

2. Print the journal entries.

Check Figure Payroll Tax Expense, $1,544.83 Problem Set B

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille