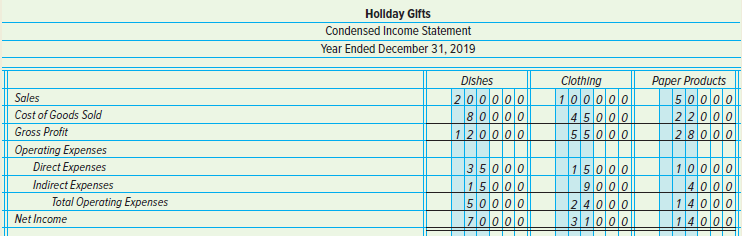

Holiday Gifts has three sales departments: dishes, clothing, and paper products. The stores condensed income statement for

Question:

The proprietor asked the auditor if the Clothing and/or Paper Products departments should be closed. In the opinion of both the owner and the auditor, if the Clothing department is closed, the total indirect expenses could possibly be reduced to $17,000. If only the Paper Products department is closed, the indirect expenses could possibly be reduced to a total of $25,000. In the opinion of the owner, if the Paper Products department is closed, a loss of $10,000 in sales could be lost by the Dishes department. This loss in sales would reduce the Dishes Cost of Goods Sold by $4,000. She also thinks that closing the Paper Products department would have no effect on sales of the Clothing department.

INSTRUCTIONS

1. Based on the preceding information, what would the estimated total profit or loss be if the Paper Goods department were closed?

2. What would the estimated total profit or loss be if the Clothing department were closed?

3. What advice would you give the proprietor?

Analyze: What is the current contribution margin for each department?

Contribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina