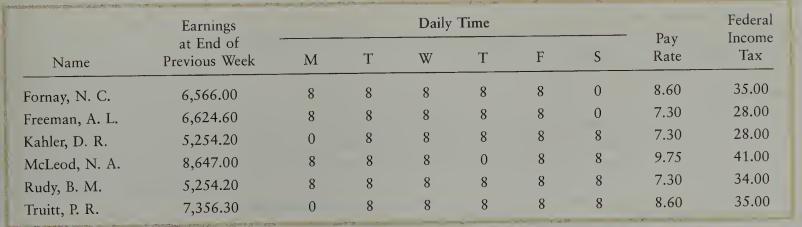

Holland Company has the follotving payroll information for the pay period ended May 14: Taxable earnings for

Question:

Holland Company has the follotving payroll information for the pay period ended May 14:

Taxable earnings for Social Security are based on the first $62,700. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000. Employees are paid time-anda-half for work in excess of 40 hours per week.

Instructions 1. Complete the payroll register, page 34. The Social Security tax rate is 6.2 per¬

cent, and the Medicare tax rate is 1.45 percent.

2. Prepare a general journal entry to record the payroll. The firm’s general ledger contains a Wages Expense account and a Wages Payable account.

3. Assuming that the firm transfers funds from its regular bank account to its special payroll bank account, make the entry in the general journal.

4. Prepare a journal entry to record the payment of wages. Begin payroll checks Check Figure ' with No. 744. Net Amount, $1,684.42

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille