The Ramsey Company pays its employees time-and-a-half for P.O. 1,2,3,4 hours worked in excess of forty per

Question:

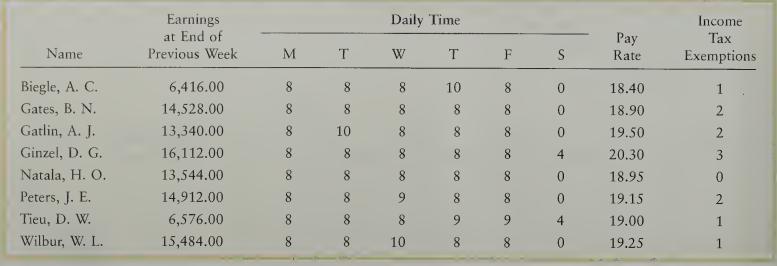

The Ramsey Company pays its employees time-and-a-half for P.O. 1,2,3,4 hours worked in excess of forty per week. The following information is available from time cards and employees’ individual earnings records for the pay period ended September 21.

Taxable earnings for Social Security are based on the first $62,700. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000.

Instructions 1. Complete the payroll register, page 72, using the wage-bracket income tax withholding table in Figure 7-3 (page 256). The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Assume that all employees are married.

2. Prepare a general journal entry to record the payroll. The firm’s general ledger contains a Wages Expense account and a Wages Payable account.

3. Assuming that the firm transfers funds from its regular bank account to its special payroll bank account, make the entry in the general journal.

4. Prepare a general journal entry to record the payment of wages. In the payroll Check Figure register, begin payroll checks with Ck. No. 863. Net Amount, $5,360.72

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille