Journalizing credit sales in a sales journal Refer to the transactions in QS 11-1. Show how these

Question:

Journalizing credit sales in a sales journal Refer to the transactions in QS 11-1. Show how these transactions would be entered in a sales journal.

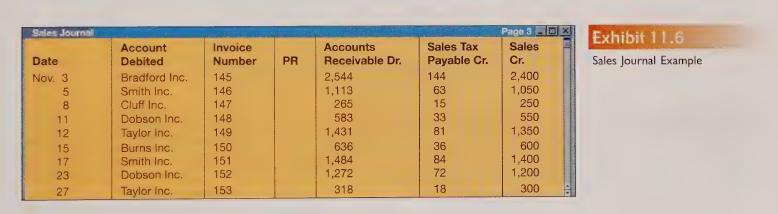

(Use Exhibit 11.6 as a guide.)

QS 11-1:

Journalizing credit sales Show the general journal entries for the following sale transactions for Martindale Company from June 2009. Sales tax equals 8% of sales price.

June

2 Sold merchandise on credit to A. Fullmer, \($3,300\) plus tax.

9 Sold merchandise on credit to B. Olson, \($2,600\) plus tax.

13. Sold merchandise on credit to P. Bleak, \($1,200\) plus tax.

27 Sold merchandise on credit to B. Taysom, \($4,100\) plus tax.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw

Question Posted: